Page 363 - Bank-Muamalat-Annual-Report-2021

P. 363

ANNUAL REPORT 2021 361

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

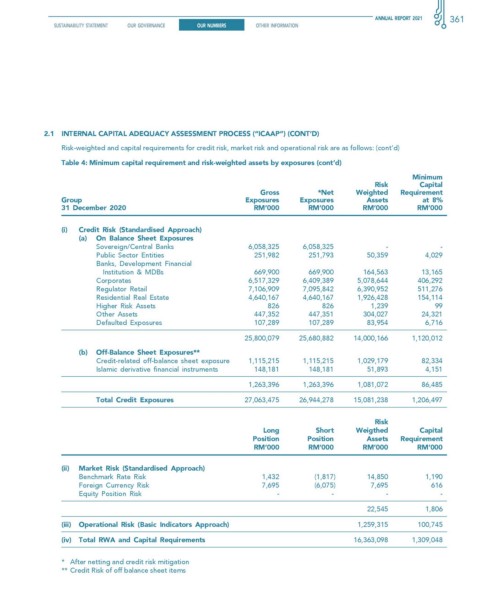

2.1 InTernAl cAPITAl ADequAcy AssessMenT Process (“IcAAP”) (conT’D)

Risk-weighted and capital requirements for credit risk, market risk and operational risk are as follows: (cont’d)

Table 4: Minimum capital requirement and risk-weighted assets by exposures (cont’d)

Minimum

risk capital

gross *net weighted requirement

group exposures exposures Assets at 8%

31 December 2020 rM’000 rM’000 rM’000 rM’000

(i) credit risk (standardised Approach)

(a) on Balance sheet exposures

Sovereign/Central Banks 6,058,325 6,058,325 - -

Public Sector Entities 251,982 251,793 50,359 4,029

Banks, Development Financial

Institution & MDBs 669,900 669,900 164,563 13,165

Corporates 6,517,329 6,409,389 5,078,644 406,292

Regulator Retail 7,106,909 7,095,842 6,390,952 511,276

Residential Real Estate 4,640,167 4,640,167 1,926,428 154,114

Higher Risk Assets 826 826 1,239 99

Other Assets 447,352 447,351 304,027 24,321

Defaulted Exposures 107,289 107,289 83,954 6,716

25,800,079 25,680,882 14,000,166 1,120,012

(b) off-Balance sheet exposures**

Credit-related off-balance sheet exposure 1,115,215 1,115,215 1,029,179 82,334

Islamic derivative financial instruments 148,181 148,181 51,893 4,151

1,263,396 1,263,396 1,081,072 86,485

Total credit exposures 27,063,475 26,944,278 15,081,238 1,206,497

risk

long short weigthed capital

Position Position Assets requirement

rM’000 rM’000 rM’000 rM’000

(ii) Market risk (standardised Approach)

Benchmark Rate Risk 1,432 (1,817) 14,850 1,190

Foreign Currency Risk 7,695 (6,075) 7,695 616

Equity Position Risk - - - -

22,545 1,806

(iii) operational risk (Basic Indicators Approach) 1,259,315 100,745

(iv) Total rwA and capital requirements 16,363,098 1,309,048

* After netting and credit risk mitigation

** Credit Risk of off balance sheet items