Page 364 - Bank-Muamalat-Annual-Report-2021

P. 364

362 BANK MUAMALAT MALAYSIA BERHAD

OUR PERFORMANCE

ABOUT US

OUR STRATEGY

OUR LEADERSHIP

ABOUT US OUR LEADERSHIP OUR STRA TEGY OUR PERFORMANCE

BASEL II

PILLAR 3 DISCLOSURE

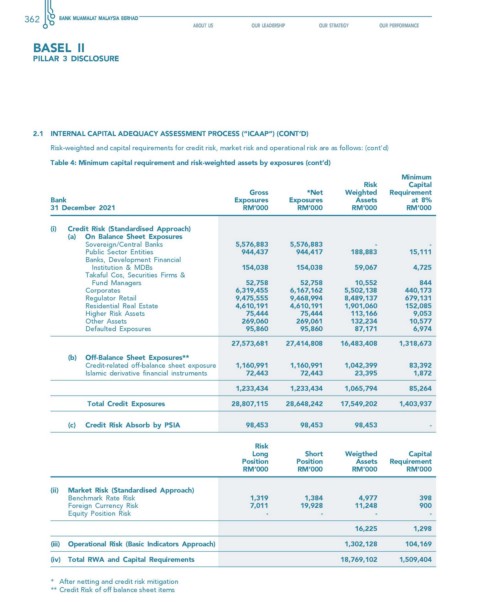

2.1 InTernAl cAPITAl ADequAcy AssessMenT Process (“IcAAP”) (conT’D)

Risk-weighted and capital requirements for credit risk, market risk and operational risk are as follows: (cont’d)

Table 4: Minimum capital requirement and risk-weighted assets by exposures (cont’d)

Minimum

risk capital

gross *net weighted requirement

Bank exposures exposures Assets at 8%

31 December 2021 rM’000 rM’000 rM’000 rM’000

(i) credit risk (standardised Approach)

(a) on Balance sheet exposures

Sovereign/Central Banks 5,576,883 5,576,883 - -

Public Sector Entities 944,437 944,417 188,883 15,111

Banks, Development Financial

Institution & MDBs 154,038 154,038 59,067 4,725

Takaful Cos, Securities Firms &

Fund Managers 52,758 52,758 10,552 844

Corporates 6,319,455 6,167,162 5,502,138 440,173

Regulator Retail 9,475,555 9,468,994 8,489,137 679,131

Residential Real Estate 4,610,191 4,610,191 1,901,060 152,085

Higher Risk Assets 75,444 75,444 113,166 9,053

Other Assets 269,060 269,061 132,234 10,577

Defaulted Exposures 95,860 95,860 87,171 6,974

27,573,681 27,414,808 16,483,408 1,318,673

(b) off-Balance sheet exposures**

Credit-related off-balance sheet exposure 1,160,991 1,160,991 1,042,399 83,392

Islamic derivative financial instruments 72,443 72,443 23,395 1,872

1,233,434 1,233,434 1,065,794 85,264

Total credit exposures 28,807,115 28,648,242 17,549,202 1,403,937

(c) credit risk Absorb by PsIA 98,453 98,453 98,453 -

risk

long short weigthed capital

Position Position Assets requirement

rM’000 rM’000 rM’000 rM’000

(ii) Market risk (standardised Approach)

Benchmark Rate Risk 1,319 1,384 4,977 398

Foreign Currency Risk 7,011 19,928 11,248 900

Equity Position Risk - - - -

16,225 1,298

(iii) operational risk (Basic Indicators Approach) 1,302,128 104,169

(iv) Total rwA and capital requirements 18,769,102 1,509,404

* After netting and credit risk mitigation

** Credit Risk of off balance sheet items