Page 312 - Bank-Muamalat-Annual-Report-2021

P. 312

310 bank MuaMalat Malaysia berhaD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

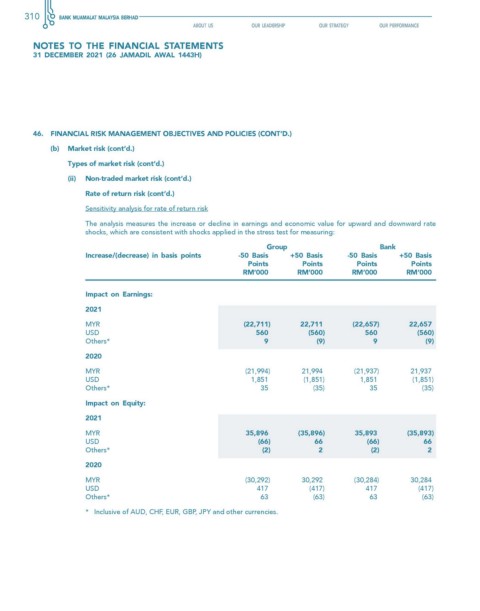

46. fINANcIAL RIsk MANAGeMeNT OBJecTIves AND POLIcIes (cONT’D.)

(b) Market risk (cont’d.)

Types of market risk (cont’d.)

(ii) Non-traded market risk (cont’d.)

Rate of return risk (cont’d.)

Sensitivity analysis for rate of return risk

The analysis measures the increase or decline in earnings and economic value for upward and downward rate

shocks, which are consistent with shocks applied in the stress test for measuring:

Group Bank

Increase/(decrease) in basis points -50 Basis +50 Basis -50 Basis +50 Basis

Points Points Points Points

rM’000 rM’000 rM’000 rM’000

Impact on earnings:

2021

MYR (22,711) 22,711 (22,657) 22,657

USD 560 (560) 560 (560)

Others* 9 (9) 9 (9)

2020

MYR (21,994) 21,994 (21,937) 21,937

USD 1,851 (1,851) 1,851 (1,851)

Others* 35 (35) 35 (35)

Impact on equity:

2021

MYR 35,896 (35,896) 35,893 (35,893)

USD (66) 66 (66) 66

Others* (2) 2 (2) 2

2020

MYR (30,292) 30,292 (30,284) 30,284

USD 417 (417) 417 (417)

Others* 63 (63) 63 (63)

* Inclusive of AUD, CHF, EUR, GBP, JPY and other currencies.