Page 234 - Bank-Muamalat-Annual-Report-2021

P. 234

232 bank MuaMalat Malaysia berhaD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

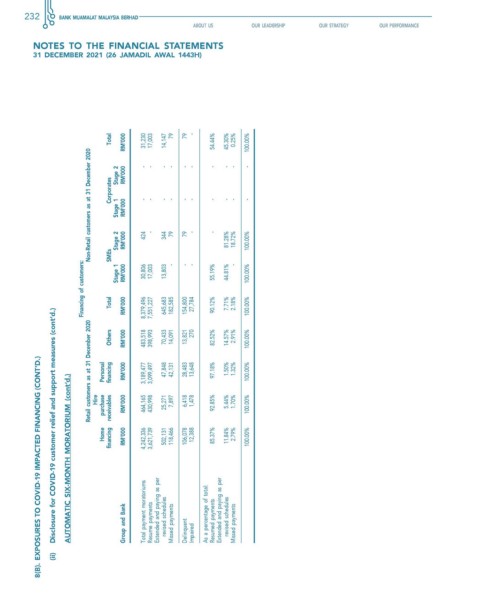

Total RM’000 31,230 - 17,003 - 14,147 - 79 - 79 - - - 54.44% - 45.30% - 0.25% - 100.00% -

Non-Retail customers as at 31 December 2020 corporates stage 2 stage 1 stage 2 RM’000 RM’000 RM’000 - 424 - - - 344 - 79 - 79 - - - - - 81.28% - 18.72% - 100.00%

financing of customers: sMes Total stage 1 RM’000 RM’000 30,806 8,379,496 17,003 7,551,227 13,803 645,683 - 182,585 - 154,800 - 27,784 55.19% 90.12% 44.81% 7.71% - 2.18% 100.00% 100.00%

Disclosure for cOvID-19 customer relief and support measures (cont’d.)

Retail customers as at 31 December 2020 Personal Others financing RM’000 RM’000 483,518 3,189,477 398,993 3,099,497 70,433 47,848 14,091 42,131 13,821 28,483 270 13,648 82.52% 97.18% 14.57% 1.50% 2.91% 1.32% 100.00% 100.00%

8(b). exPOsuRes TO cOvID-19 IMPAcTeD fINANcING (cONT’D.)

AuTOMATIc sIx-MONTh MORATORIuM (cont’d.)

home financing RM’000 4,242,336 3,621,739 502,131 118,466 106,078 12,388 85.37% 11.84% 2.79% 100.00%

hire purchase receivables RM’000 464,165 430,998 25,271 7,897 6,418 1,478 92.85% 5.44% 1.70% 100.00%

Group and Bank Total payment moratoriums Resume payments Extended and paying as per revised schedules Missed payments As a percentage of total: Resumed payments Extended and paying as per revised schedules Missed payments

Delinquent Impaired

(ii)