Page 230 - Bank-Muamalat-Annual-Report-2021

P. 230

228 bank MuaMalat Malaysia berhaD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

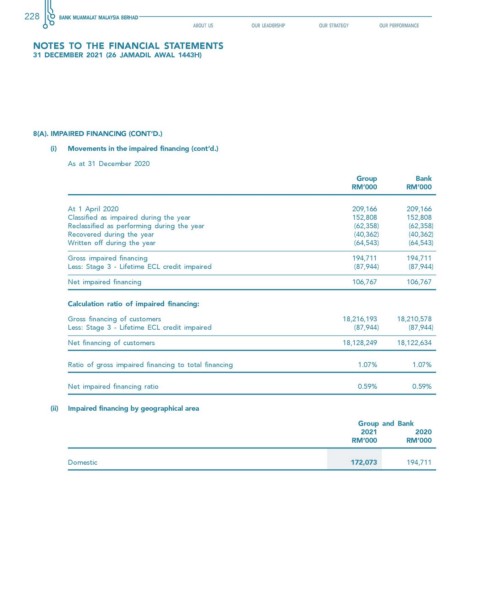

8(a). IMPAIReD fINANcING (cONT’D.)

(i) Movements in the impaired financing (cont’d.)

As at 31 December 2020

Group Bank

rM’000 rM’000

At 1 April 2020 209,166 209,166

Classified as impaired during the year 152,808 152,808

Reclassified as performing during the year (62,358) (62,358)

Recovered during the year (40,362) (40,362)

Written off during the year (64,543) (64,543)

Gross impaired financing 194,711 194,711

Less: Stage 3 - Lifetime ECL credit impaired (87,944) (87,944)

Net impaired financing 106,767 106,767

calculation ratio of impaired financing:

Gross financing of customers 18,216,193 18,210,578

Less: Stage 3 - Lifetime ECL credit impaired (87,944) (87,944)

Net financing of customers 18,128,249 18,122,634

Ratio of gross impaired financing to total financing 1.07% 1.07%

Net impaired financing ratio 0.59% 0.59%

(ii) Impaired financing by geographical area

Group and Bank

2021 2020

rM’000 rM’000

Domestic 172,073 194,711