Page 228 - Bank-Muamalat-Annual-Report-2021

P. 228

226 bank MuaMalat Malaysia berhaD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

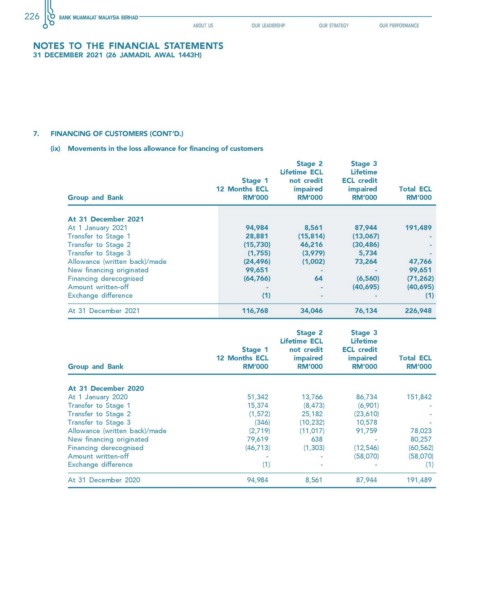

7. fINANcING Of cusTOMeRs (cONT’D.)

(ix) Movements in the loss allowance for financing of customers

stage 2 stage 3

Lifetime ecL Lifetime

stage 1 not credit ecL credit

12 Months ecL impaired impaired Total ecL

Group and Bank RM’000 RM’000 RM’000 RM’000

At 31 December 2021

At 1 January 2021 94,984 8,561 87,944 191,489

Transfer to Stage 1 28,881 (15,814) (13,067) -

Transfer to Stage 2 (15,730) 46,216 (30,486) -

Transfer to Stage 3 (1,755) (3,979) 5,734 -

Allowance (written back)/made (24,496) (1,002) 73,264 47,766

New financing originated 99,651 - - 99,651

Financing derecognised (64,766) 64 (6,560) (71,262)

Amount written-off - - (40,695) (40,695)

Exchange difference (1) - - (1)

At 31 December 2021 116,768 34,046 76,134 226,948

stage 2 stage 3

Lifetime ecL Lifetime

stage 1 not credit ecL credit

12 Months ecL impaired impaired Total ecL

Group and Bank RM’000 RM’000 RM’000 RM’000

At 31 December 2020

At 1 January 2020 51,342 13,766 86,734 151,842

Transfer to Stage 1 15,374 (8,473) (6,901) -

Transfer to Stage 2 (1,572) 25,182 (23,610) -

Transfer to Stage 3 (346) (10,232) 10,578 -

Allowance (written back)/made (2,719) (11,017) 91,759 78,023

New financing originated 79,619 638 - 80,257

Financing derecognised (46,713) (1,303) (12,546) (60,562)

Amount written-off - - (58,070) (58,070)

Exchange difference (1) - - (1)

At 31 December 2020 94,984 8,561 87,944 191,489