Page 229 - Bank-Muamalat-Annual-Report-2021

P. 229

ANNUAL REPORT 2021 227

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

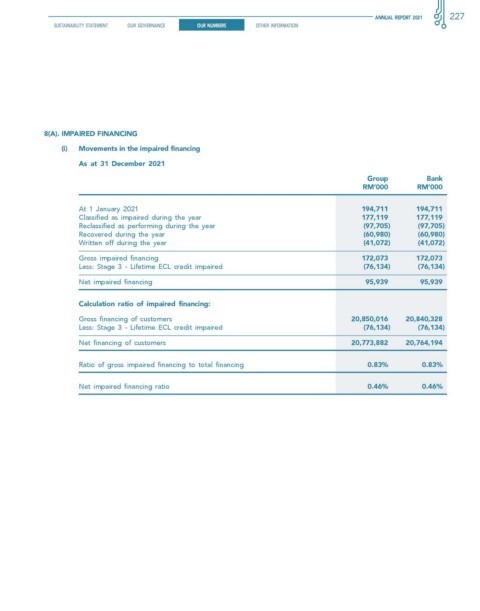

8(a). IMPAIReD fINANcING

(i) Movements in the impaired financing

As at 31 December 2021

Group Bank

rM’000 rM’000

At 1 January 2021 194,711 194,711

Classified as impaired during the year 177,119 177,119

Reclassified as performing during the year (97,705) (97,705)

Recovered during the year (60,980) (60,980)

Written off during the year (41,072) (41,072)

Gross impaired financing 172,073 172,073

Less: Stage 3 - Lifetime ECL credit impaired (76,134) (76,134)

Net impaired financing 95,939 95,939

calculation ratio of impaired financing:

Gross financing of customers 20,850,016 20,840,328

Less: Stage 3 - Lifetime ECL credit impaired (76,134) (76,134)

Net financing of customers 20,773,882 20,764,194

Ratio of gross impaired financing to total financing 0.83% 0.83%

Net impaired financing ratio 0.46% 0.46%