Page 236 - Bank-Muamalat-Annual-Report-2021

P. 236

234 bank MuaMalat Malaysia berhaD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

8(b). exPOsuRes TO cOvID-19 IMPAcTeD fINANcING (cONT’D.)

(iii) Overlays and adjustments for expected credit losses amid cOvID-19 environment

As the current MFRS 9 models are not expected to generate levels of expected credit losses (“ECL”) with sufficient

reliability in view of the unprecedented and on-going COVID-19 pandemic, overlays and post-model adjustments have

been applied to determine a sufficient overall level of ECL for the financial year ended 31 December 2021.

The overlays and post-model adjustments involved significant level of judgement and reflect the management’s views

of possible severities of the pandemic and paths of recovery in the forward looking assessment for ECL estimation

purposes.

The financing customers who have received payment supports remain in their existing stages unless they have been

individually identified as not viable or with subsequent indicators of significant increase in credit risk from each of their

pre-COVID-19 status. The overlays and post-model adjustments were generally made at portfolio level in determining

the sufficient level of ECL.

The total ECL overlays for the financial year ended 31 December 2021 is approximately 29.7% (2020: 14.5%) of the

Bank’s total ECL.

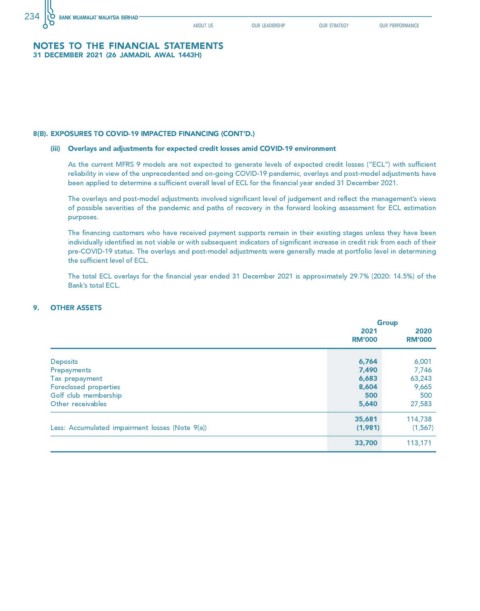

9. OTheR AsseTs

Group

2021 2020

rM’000 rM’000

Deposits 6,764 6,001

Prepayments 7,490 7,746

Tax prepayment 6,683 63,243

Foreclosed properties 8,604 9,665

Golf club membership 500 500

Other receivables 5,640 27,583

35,681 114,738

Less: Accumulated impairment losses (Note 9(a)) (1,981) (1,567)

33,700 113,171