Page 149 - Bank-Muamalat-Annual-Report-2021

P. 149

ANNUAL REPORT 2021 147

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

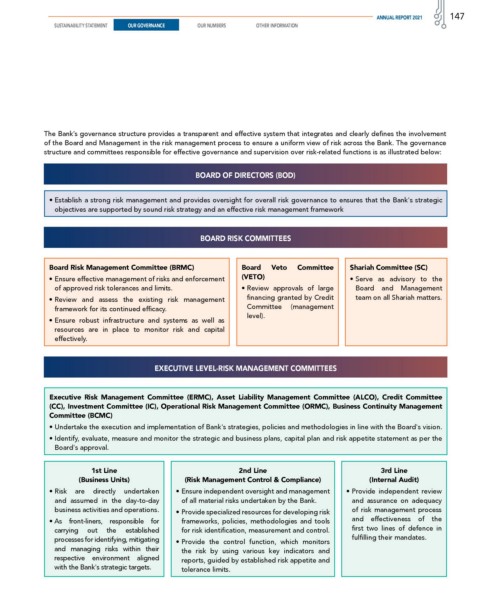

The Bank’s governance structure provides a transparent and effective system that integrates and clearly defines the involvement

of the Board and Management in the risk management process to ensure a uniform view of risk across the Bank. The governance

structure and committees responsible for effective governance and supervision over risk-related functions is as illustrated below:

BOARD OF DIRECTORS (BOD)

• Establish a strong risk management and provides oversight for overall risk governance to ensures that the Bank's strategic

objectives are supported by sound risk strategy and an effective risk management framework

BOARD RISK COMMITTEES

Board Risk Management Committee (BRMC) Board Veto Committee Shariah Committee (SC)

• Ensure effective management of risks and enforcement (VETO) • Serve as advisory to the

of approved risk tolerances and limits. • Review approvals of large Board and Management

• Review and assess the existing risk management financing granted by Credit team on all Shariah matters.

framework for its continued efficacy. Committee (management

level).

• Ensure robust infrastructure and systems as well as

resources are in place to monitor risk and capital

effectively.

EXECUTIVE LEVEL-RISK MANAGEMENT COMMITTEES

Executive Risk Management Committee (ERMC), Asset Liability Management Committee (ALCO), Credit Committee

(CC), Investment Committee (IC), Operational Risk Management Committee (ORMC), Business Continuity Management

Committee (BCMC)

• Undertake the execution and implementation of Bank's strategies, policies and methodologies in line with the Board's vision.

• Identify, evaluate, measure and monitor the strategic and business plans, capital plan and risk appetite statement as per the

Board's approval.

1st Line 2nd Line 3rd Line

(Business Units) (Risk Management Control & Compliance) (Internal Audit)

• Risk are directly undertaken • Ensure independent oversight and management • Provide independent review

and assumed in the day-to-day of all material risks undertaken by the Bank. and assurance on adequacy

business activities and operations. • Provide specialized resources for developing risk of risk management process

• As front-liners, responsible for frameworks, policies, methodologies and tools and effectiveness of the

carrying out the established for risk identification, measurement and control. first two lines of defence in

processes for identifying, mitigating • Provide the control function, which monitors fulfilling their mandates.

and managing risks within their the risk by using various key indicators and

respective environment aligned reports, guided by established risk appetite and

with the Bank's strategic targets. tolerance limits.