Page 412 - Bank-Muamalat-AR2020

P. 412

410 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

BASEL II

PILLAr 3 DISCLOSurE

8.4 LIquIDITy rISk (CONT’D)

Liquidity and Funding risk (cont’d)

To effectively manage its liquidity, the Bank has the following policies and strategies in place:

• Management under normal condition:

Normal condition is defined as the situation in which the Bank is able to meet any liquidity demands when they come

due.

The Bank monitors its liquidity positions through liquidity controls such as maximum cumulative outflows, deposits

concentration, financing to deposits ratio, and controlled financing draw down level.

• Management under crisis condition:

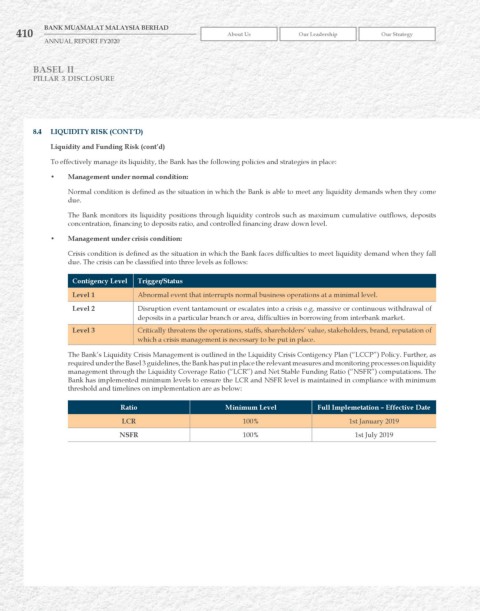

Crisis condition is defined as the situation in which the Bank faces difficulties to meet liquidity demand when they fall

due. The crisis can be classified into three levels as follows:

Contigency Level Trigger/Status

Level 1 Abnormal event that interrupts normal business operations at a minimal level.

Level 2 Disruption event tantamount or escalates into a crisis e.g. massive or continuous withdrawal of

deposits in a particular branch or area, difficulties in borrowing from interbank market.

Level 3 Critically threatens the operations, staffs, shareholders’ value, stakeholders, brand, reputation of

which a crisis management is necessary to be put in place.

The Bank’s Liquidity Crisis Management is outlined in the Liquidity Crisis Contigency Plan (“LCCP”) Policy. Further, as

required under the Basel 3 guidelines, the Bank has put in place the relevant measures and monitoring processes on liquidity

management through the Liquidity Coverage Ratio (“LCR”) and Net Stable Funding Ratio (“NSFR”) computations. The

Bank has implemented minimum levels to ensure the LCR and NSFR level is maintained in compliance with minimum

threshold and timelines on implementation are as below:

ratio Minimum Level Full Implemetation – Effective Date

LCr 100% 1st January 2019

NSFr 100% 1st July 2019