Page 41 - Bank-Muamalat-AR2020

P. 41

39

Governance

Our Performance Sustainability Statement Our Governance Our Numbers Other Information

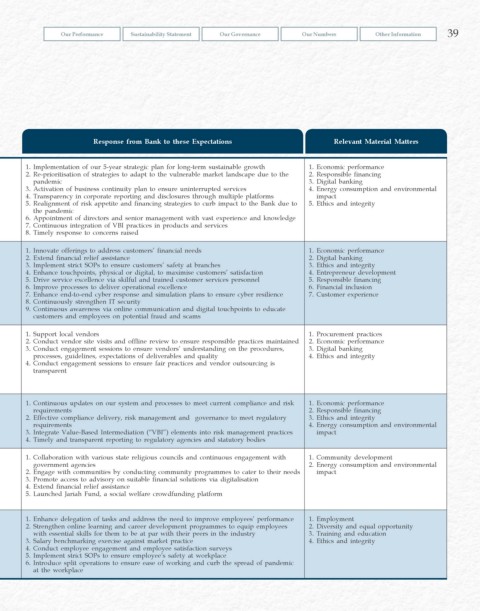

Response from Bank to these Expectations Relevant Material Matters

Shareholders 1. Annual reports 1. Sustainable financial returns with prudent cost management 1. Implementation of our 5-year strategic plan for long-term sustainable growth 1. Economic performance

& Investors 2. Sustainability statements 2. Proactive management of asset quality and credit risks from 2. Re-prioritisation of strategies to adapt to the vulnerable market landscape due to the 2. Responsible financing

3. Quarterly financial announcements exposure to sectors affected by the pandemic pandemic 3. Digital banking

4. Online communications (e-mail, 3. Sound balance sheet management 3. Activation of business continuity plan to ensure uninterrupted services 4. Energy consumption and environmental

corporate website, social media) 4. Sustainable and long-term business strategy 4. Transparency in corporate reporting and disclosures through multiple platforms impact

5. Meetings and discussions (upon 5. Integration of VBI elements in business operations 5. Realignment of risk appetite and financing strategies to curb impact to the Bank due to 5. Ethics and integrity

request) 6. Ethical and responsible business conduct the pandemic

7. Strong and experienced directors and management 6. Appointment of directors and senior management with vast experience and knowledge

8. Transparent reporting and disclosures 7. Continuous integration of VBI practices in products and services

9. Initiatives to mitigate effects of the pandemic 8. Timely response to concerns raised

1. Digital touchpoints: internet banking, 1. Innovative financial solutions in products and services offered 1. Innovate offerings to address customers’ financial needs 1. Economic performance

Customers digital apps 2. Convenient, continuous and safe access to banking services during 2. Extend financial relief assistance 2. Digital banking

2. Online communications (e-mails, the pandemic 3. Implement strict SOPs to ensure customers’ safety at branches 3. Ethics and integrity

corporate website, social media) 3. Value-for-banking products and services that are both competitive 4. Enhance touchpoints, physical or digital, to maximise customers’ satisfaction 4. Entrepreneur development

3. Sales & Customer Service Centres and transparent 5. Drive service excellence via skilful and trained customer services personnel 5. Responsible financing

4. Call centres 4. Secured and safe environment to conduct banking activities 6. Improve processes to deliver operational excellence 6. Financial inclusion

5. Customer networking events especially through digital channels with strict customers data 7. Enhance end-to-end cyber response and simulation plans to ensure cyber resilience 7. Customer experience

6. Representatives at branches protection 8. Continuously strengthen IT security

7. Printed materials 5. Excellent customer service 9. Continuous awareness via online communication and digital touchpoints to educate

8. Customers survey customers and employees on potential fraud and scams

Business 1. Online communications (e-mail, 1. Convenient access to procurement systems 1. Support local vendors 1. Procurement practices

Partners corporate website, social media) 2. Fair and equal evaluation of vendors and their proposals 2. Conduct vendor site visits and offline review to ensure responsible practices maintained 2. Economic performance

2. Formal & informal engagements 3. Communicate fair conditions that satisfy both suppliers and the 3. Conduct engagement sessions to ensure vendors’ understanding on the procedures, 3. Digital banking

3. E-Procurement system Bank’s needs processes, guidelines, expectations of deliverables and quality 4. Ethics and integrity

4. Communicate new policies, guidelines or strategies to ensure 4. Conduct engagement sessions to ensure fair practices and vendor outsourcing is

optimal performance transparent

5. Transparent reporting and disclosures to ensure smooth

collaboration with potential partners

Regulatory 1. Regular updates and reporting to 1. Compliance with all legal and regulatory requirements 1. Continuous updates on our system and processes to meet current compliance and risk 1. Economic performance

Agencies & regulators 2. Good corporate governance requirements 2. Responsible financing

Statutory 2. Actively participate in regulatory 3. Transparent reporting and disclosures 2. Effective compliance delivery, risk management and governance to meet regulatory 3. Ethics and integrity

Bodies forums, briefings, meetings, 4. Active participation and contribution to industry and regulatory requirements 4. Energy consumption and environmental

conferences and consultation papers working group 3. Integrate Value-Based Intermediation (“VBI”) elements into risk management practices impact

4. Timely and transparent reporting to regulatory agencies and statutory bodies

Local 1. Community engagement activities 1. Financial and VBI literacy awareness 1. Collaboration with various state religious councils and continuous engagement with 1. Community development

Community 2. Online communications (e-mails, 2. Bank-led efforts in tackling common social, economic and government agencies 2. Energy consumption and environmental

corporate website, social media) environmental issues 2. Engage with communities by conducting community programmes to cater to their needs impact

3. Digital touchpoints: mobile apps, 3. Providing feasible and convenient access to advisory on suitable 3. Promote access to advisory on suitable financial solutions via digitalisation

internet banking, SMS blasts) financial solutions 4. Extend financial relief assistance

4. Live forums like Fadhilat Muamalat 4. Social responsibility role in building a resilient and thriving 5. Launched Jariah Fund, a social welfare crowdfunding platform

5. Printed materials community

1. Bank’s internal portal and e-mails 1. Fair remuneration, recognition and effective performance 1. Enhance delegation of tasks and address the need to improve employees’ performance 1. Employment

Employees 2. Employee dialogue sessions with CEO management 2. Strengthen online learning and career development programmes to equip employees 2. Diversity and equal opportunity

3. Annual engagement survey 2. Balanced work-life environment with essential skills for them to be at par with their peers in the industry 3. Training and education

4. Social and recreational activities 3. Various opportunities for career development and advancement 3. Salary benchmarking exercise against market practice 4. Ethics and integrity

5. Regular employee engagement events 4. An empowering environment that embraces diversity and enables 4. Conduct employee engagement and employee satisfaction surveys

and programmes employees to deliver quality work output 5. Implement strict SOPs to ensure employee’s safety at workplace

6. Meetings and roadshows 5. A safe, healthy and conducive workplace supported by flexible 6. Introduce split operations to ensure ease of working and curb the spread of pandemic

work practices at the workplace