Page 377 - Bank-Muamalat-AR2020

P. 377

375

Our Performance Sustainability Statement Governance Our Numbers Other Information

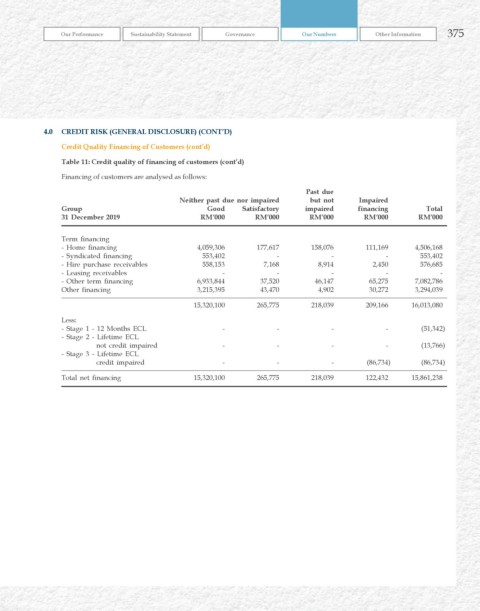

4.0 CrEDIT rISk (GENErAL DISCLOSurE) (CONT’D)

Credit quality Financing of Customers (cont’d)

Table 11: Credit quality of financing of customers (cont’d)

Financing of customers are analysed as follows:

Past due

Neither past due nor impaired but not Impaired

Group Good Satisfactory impaired financing Total

31 December 2019 rM’000 rM’000 rM’000 rM’000 rM’000

Term financing

- Home financing 4,059,306 177,617 158,076 111,169 4,506,168

- Syndicated financing 553,402 - - - 553,402

- Hire purchase receivables 558,153 7,168 8,914 2,450 576,685

- Leasing receivables - - - - -

- Other term financing 6,933,844 37,520 46,147 65,275 7,082,786

Other financing 3,215,395 43,470 4,902 30,272 3,294,039

15,320,100 265,775 218,039 209,166 16,013,080

Less:

- Stage 1 - 12 Months ECL - - - - (51,342)

- Stage 2 - Lifetime ECL

not credit impaired - - - - (13,766)

- Stage 3 - Lifetime ECL

credit impaired - - - (86,734) (86,734)

Total net financing 15,320,100 265,775 218,039 122,432 15,861,238