Page 303 - Bank-Muamalat-AR2020

P. 303

301

Our Performance Sustainability Statement Governance Our Numbers Other Information

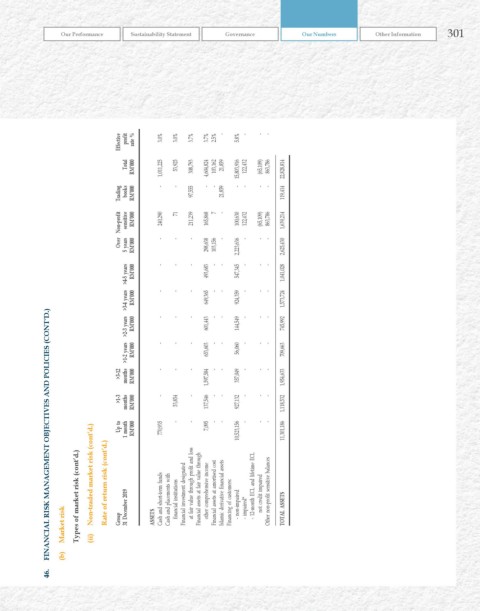

Effective profit rate % 3.0% 3.0% 3.7% 3.7% 2.5% - 5.8% - - -

Total rM’000 1,011,225 53,925 308,793 4,604,824 103,162 21,859 15,803,916 122,432 (65,109) 863,786 22,828,814

Trading books rM’000 - - 97,555 - - 21,859 - - - - 119,414

Over Non-profit sensitive 5 years rM’000 rM’000 240,290 - 71 - 211,239 - 165,868 298,638 7 103,156 - - 100,630 2,223,636 122,432 - (65,109) - 863,786 - 1,639,214 2,625,430

months >1-2 years >2-3 years >3-4 years >4-5 years rM’000 601,443 144,549 745,992

rM’000 - - - 493,683 - - 547,345 - - - 1,041,028

rM’000 - - - 649,365 - - 924,359 - - - 1,573,724

FINANCIAL rISk MANAGEMENT OBJECTIvES AND POLICIES (CONT’D.)

- - - - - - - -

rM’000 - - - 653,603 - - 56,060 - - - 709,663

>3-12 rM’000 - - - 1,597,584 - - 357,049 - - - 1,954,633

>1-3 up to months 1 month rM’000 rM’000 - 770,935 53,854 - - - 137,546 7,095 - - - - 927,132 10,523,156 - - - - - - 1,118,532 11,301,186

Types of market risk (cont’d.) Non-traded market risk (cont’d.) rate of return risk (cont’d.) 31 December 2019 Cash and short-term funds Cash and placements with financial institutions Financial investment designated at fair value through profit and loss Financial assets at fair value through other comprehensive income Financial assets at amortised cost Islamic derivative financial assets Financing of customers: - non-impaired - impaired* - 12

Market risk (ii) Group ASSETS

(b)

46.