Page 305 - Bank-Muamalat-AR2020

P. 305

303

Our Performance Sustainability Statement Governance Our Numbers Other Information

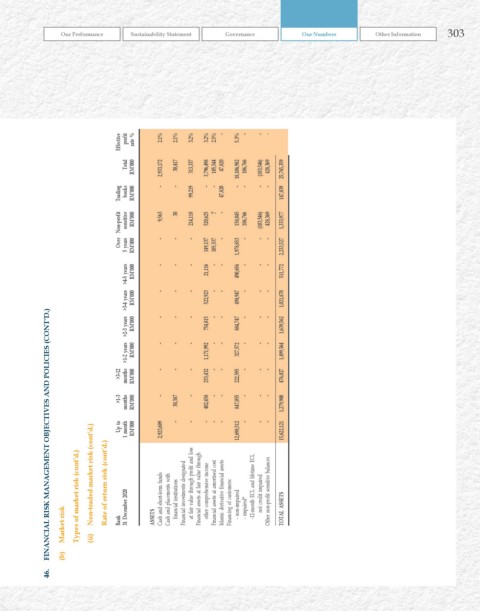

Effective profit rate % 2.1% 2.1% 3.2% 3.2% 2.5% - 5.3% - - -

Total rM’000 2,933,172 30,417 313,337 3,796,498 105,544 47,820 18,106,982 106,766 (103,546) 428,369 25,765,359

Trading books rM’000 - - 99,219 - - 47,820 - - - - 147,039

Over Non-profit sensitive 5 years rM’000 rM’000 9,563 - 30 - 214,118 - 520,625 149,137 7 105,537 - - 158,045 1,978,853 106,766 - (103,546) - 428,369 - 1,333,977 2,233,527

months >1-2 years >2-3 years >3-4 years >4-5 years rM’000 754,815 884,747 1,639,562

rM’000 - - - 21,116 - - 490,656 - - - 511,772

rM’000 - - - 522,923 - - 498,947 - - - 1,021,870

FINANCIAL rISk MANAGEMENT OBJECTIvES AND POLICIES (CONT’D.)

- - - - - - - -

rM’000 - - - 1,171,992 - - 327,572 - - - 1,499,564

>3-12 rM’000 - - - 253,432 - - 222,595 - - - 476,027

>1-3 up to months 1 month rM’000 rM’000 - 2,923,609 30,387 - - - 402,458 - - - - - 847,055 12,698,512 - - - - - - 1,279,900 15,622,121

Types of market risk (cont’d.) Non-traded market risk (cont’d.) rate of return risk (cont’d.) 31 December 2020 Cash and short-term funds Cash and placements with financial institutions Financial investments designated at fair value through profit and loss Financial assets at fair value through other comprehensive income Financial assets at amortised cost Islamic derivative financial assets Financing of customers: - non-impaired - impaired* -12-mon

Market risk (ii) Bank ASSETS

(b)

46.