Page 308 - Bank-Muamalat-AR2020

P. 308

306 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

Notes to the fiNaNcial statemeNts

31 December 2020 (16 JamaDil awal 1442h)

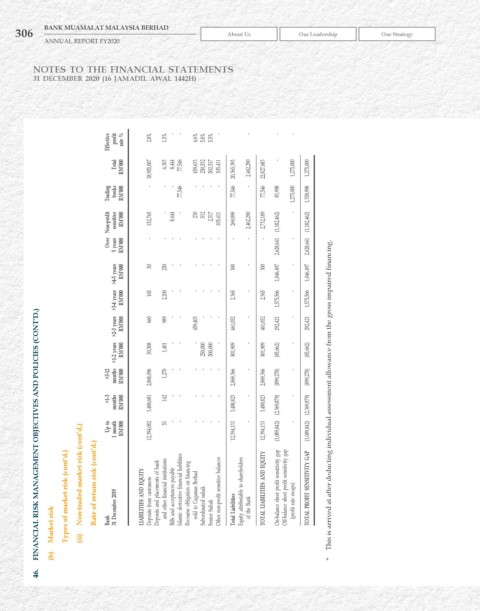

Effective profit rate % 2.8% 1.5% - - 4.6% 5.8% 5.5% - - - -

Total rM’000 18,955,007 6,303 8,444 77,546 459,633 250,532 502,517 105,411 20,365,393 2,462,290 22,827,683 1,275,000 1,275,000

-

Trading books rM’000 - - - 77,546 - - - - 77,546 - 77,546 83,998 1,275,000 1,358,998

Over Non-profit sensitive 5 years rM’000 rM’000 152,765 - - - 8,444 - - - 230 - 532 - 2,517 - 105,411 - 269,899 - 2,462,290 - 2,732,189 - (1,182,462) 2,628,641 - - (1,182,462) 2,628,641

months >1-2 years >2-3 years >3-4 years >4-5 years rM’000 459,403 461,052 461,052 292,421 292,421

rM’000 50 250 - - - - - - 300 - 300 1,046,497 - 1,046,497

rM’000 165 2,200 - - - - - - 2,365 - 2,365 1,575,566 - 1,575,566

FINANCIAL rISk MANAGEMENT OBJECTIvES AND POLICIES (CONT’D.)

660 989 - - - - - - -

rM’000 50,508 1,401 - - - 250,000 500,000 - 801,909 - 801,909 (85,662) - (85,662)

>3-12 rM’000 2,868,096 1,270 - - - - - - 2,869,366 - 2,869,366 (899,278) - (899,278)

>1-3 up to months 1 month rM’000 rM’000 3,488,681 12,394,082 142 51 - - - - - - - - - - - - 3,488,823 12,394,133 - - 3,488,823 12,394,133 (2,369,879) (1,089,842) - - (2,369,879) (1,089,842) This is arrived at after deducting individual assessment allowance from the gross impaired financing.

Types of market risk (cont’d.) Non-traded market risk (cont’d.) rate of return risk (cont’d.) 31 December 2019 LIABILITIES AND EquITy Deposits from customers Deposits and placements of bank and other financial institutions Bills and acceptances payable Islamic derivative financial liabilities Recourse obligation on financing sold to Cagamas Berhad Subordinated sukuk Other non-profit sensitive balances Total Liabilities Equity attributable to sharehold

Market risk (ii) Bank Senior Sukuk

(b) *

46.