Page 281 - Bank-Muamalat-AR2020

P. 281

279

Our Performance Sustainability Statement Governance Our Numbers Other Information

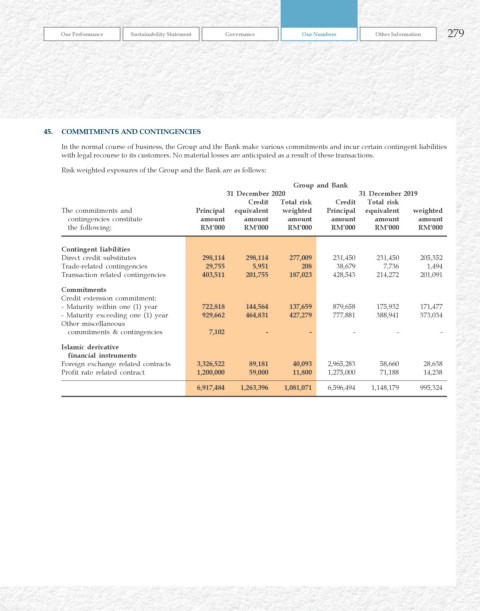

45. COMMITMENTS AND CONTINGENCIES

In the normal course of business, the Group and the Bank make various commitments and incur certain contingent liabilities

with legal recourse to its customers. No material losses are anticipated as a result of these transactions.

Risk weighted exposures of the Group and the Bank are as follows:

Group and Bank

31 December 2020 31 December 2019

Credit Total risk Credit Total risk

The commitments and Principal equivalent weighted Principal equivalent weighted

contingencies constitute amount amount amount amount amount amount

the following: rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

Contingent liabilities

Direct credit substitutes 298,114 298,114 277,009 231,450 231,450 205,352

Trade-related contingencies 29,755 5,951 208 38,679 7,736 1,494

Transaction related contingencies 403,511 201,755 187,023 428,543 214,272 201,091

Commitments

Credit extension commitment:

- Maturity within one (1) year 722,818 144,564 137,659 879,658 175,932 171,477

- Maturity exceeding one (1) year 929,662 464,831 427,279 777,881 388,941 373,034

Other miscellaneous

commitments & contingencies 7,102 - - - - -

Islamic derivative

financial instruments

Foreign exchange related contracts 3,326,522 89,181 40,093 2,965,283 58,660 28,638

Profit rate related contract 1,200,000 59,000 11,800 1,275,000 71,188 14,238

6,917,484 1,263,396 1,081,071 6,596,494 1,148,179 995,324