Page 278 - Bank-Muamalat-AR2020

P. 278

276 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

Notes to the fiNaNcial statemeNts

31 December 2020 (16 JamaDil awal 1442h)

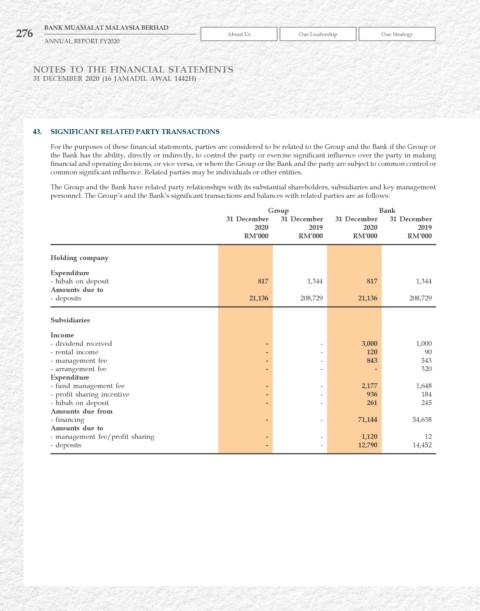

43. SIGNIFICANT rELATED PArTy TrANSACTIONS

For the purposes of these financial statements, parties are considered to be related to the Group and the Bank if the Group or

the Bank has the ability, directly or indirectly, to control the party or exercise significant influence over the party in making

financial and operating decisions, or vice versa, or where the Group or the Bank and the party are subject to common control or

common significant influence. Related parties may be individuals or other entities.

The Group and the Bank have related party relationships with its substantial shareholders, subsidiaries and key management

personnel. The Group’s and the Bank’s significant transactions and balances with related parties are as follows:

Group Bank

31 December 31 December 31 December 31 December

2020 2019 2020 2019

rM’000 rM’000 rM’000 rM’000

holding company

Expenditure

- hibah on deposit 817 1,344 817 1,344

Amounts due to

- deposits 21,136 208,729 21,136 208,729

Subsidiaries

Income

- dividend received - - 3,000 1,000

- rental income - - 120 90

- management fee - - 843 543

- arrangement fee - - - 320

Expenditure

- fund management fee - - 2,177 1,648

- profit sharing incentive - - 936 184

- hibah on deposit - - 261 245

Amounts due from

- financing - - 71,144 54,638

Amounts due to

- management fee/profit sharing - - 1,120 12

- deposits - - 12,790 14,452