Page 277 - Bank-Muamalat-AR2020

P. 277

275

Our Performance Sustainability Statement Governance Our Numbers Other Information

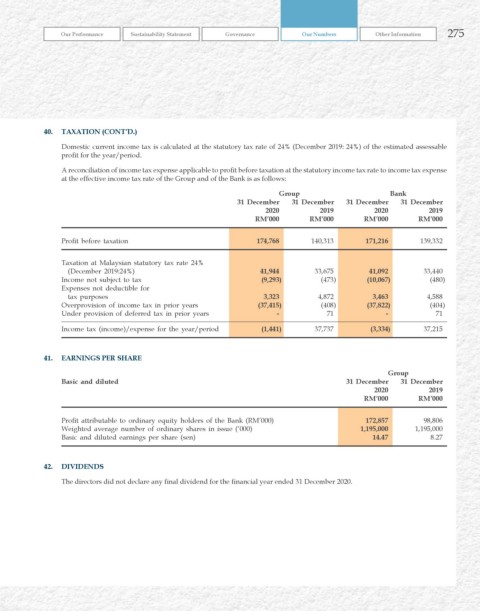

40. TAxATION (CONT’D.)

Domestic current income tax is calculated at the statutory tax rate of 24% (December 2019: 24%) of the estimated assessable

profit for the year/period.

A reconciliation of income tax expense applicable to profit before taxation at the statutory income tax rate to income tax expense

at the effective income tax rate of the Group and of the Bank is as follows:

Group Bank

31 December 31 December 31 December 31 December

2020 2019 2020 2019

rM’000 rM’000 rM’000 rM’000

Profit before taxation 174,768 140,313 171,216 139,332

Taxation at Malaysian statutory tax rate 24%

(December 2019:24%) 41,944 33,675 41,092 33,440

Income not subject to tax (9,293) (473) (10,067) (480)

Expenses not deductible for

tax purposes 3,323 4,872 3,463 4,588

Overprovision of income tax in prior years (37,415) (408) (37,822) (404)

Under provision of deferred tax in prior years - 71 - 71

Income tax (income)/expense for the year/period (1,441) 37,737 (3,334) 37,215

41. EArNINGS PEr ShArE

Group

Basic and diluted 31 December 31 December

2020 2019

rM’000 rM’000

Profit attributable to ordinary equity holders of the Bank (RM’000) 172,857 98,806

Weighted average number of ordinary shares in issue (‘000) 1,195,000 1,195,000

Basic and diluted earnings per share (sen) 14.47 8.27

42. DIvIDENDS

The directors did not declare any final dividend for the financial year ended 31 December 2020.