Page 286 - Bank-Muamalat-AR2020

P. 286

284 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

Notes to the fiNaNcial statemeNts

31 December 2020 (16 JamaDil awal 1442h)

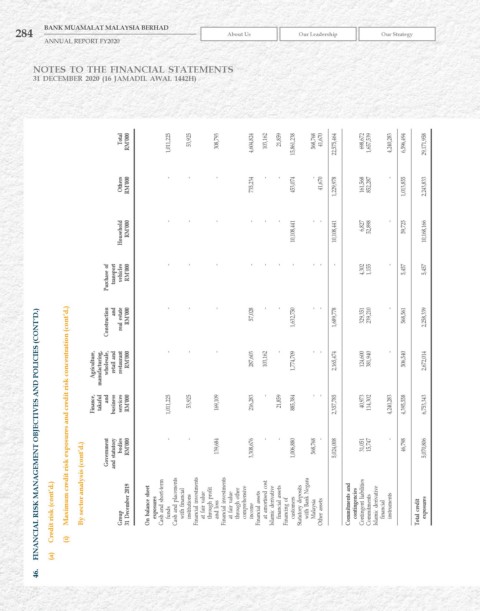

Total rM’000 1,011,225 53,925 308,793 4,604,824 103,162 21,859 15,861,238 568,768 41,670 22,575,464 698,672 1,657,539 4,240,283 6,596,494 29,171,958

Others rM’000 - - - 735,234 - - 453,074 - 41,670 1,229,978 161,568 852,287 - 1,013,855 2,243,833

household rM’000 - - - - - - 10,108,441 - - 10,108,441 6,827 52,898 - 59,725 10,168,166

Purchase of transport vehicles rM’000 - - - - - - - - - - 4,302 1,155 - 5,457 5,457

Construction and real estate rM’000 - - - 57,028 - - 1,632,750 - - 1,689,778 329,351 239,210 - 568,561 2,258,339

Maximum credit risk exposures and credit risk concentration (cont’d.)

FINANCIAL rISk MANAGEMENT OBJECTIvES AND POLICIES (CONT’D.)

Agriculture, manufacturing, wholesale, retail and restaurant rM’000 - - - 287,603 103,162 - 1,774,709 - - 2,165,474 124,600 381,940 - 506,540 2,672,014

Finance, takaful and business services rM’000 1,011,225 53,925 169,109 216,283 - 21,859 885,384 - - 2,357,785 40,973 114,302 4,240,283 4,395,558 6,753,343

Government and statutory bodies rM’000 - - 139,684 3,308,676 - - 1,006,880 568,768 - 5,024,008 31,051 15,747 - 46,798 5,070,806

Credit risk (cont’d.) By sector analysis (cont’d.) Group 31 December 2019 On balance sheet exposures Cash and short-term funds Cash and placements with financial institutions Financial investments at fair value through profit and loss Financial investments at fair value through other comprehensive income Financial assets at amortised cost Islamic derivative financial assets Financing of customers Statu

(a) (i)

46.