Page 148 - Bank-Muamalat-AR2020

P. 148

146 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

About Us

ANNUAL REPORT FY2020

STATEMENT ON RISK MANAGEMENT AND

INTERNAL CONTROL

During the year, several initiatives The Bank’s risk management framework addresses both market risk and asset-

were implemented to improve the liability management, where market risk exposures are managed and controlled

management of credit risk. These in order to optimise return on risk and maintain a balance sheet profile that is

include enhancements of credit risk consistent with the approved strategic business plan and risk appetite statement.

reports to facilitate decision making

process, continuous enhancements of The Framework covers key risk management practices such as risk identification,

the risk acceptance criteria, development measurement, mitigation, monitoring and control, which are performed under a

and calibration of application and formal governance and oversight structure. An independent market risk control

behavioral scorecards, revision to function is responsible for measuring risk exposures according to established

the internal prudential limits and policies and guidelines and reports to the Asset Liability Committee (“ALCO”) on

strengthening of provisioning practices a monthly basis. Balance sheet and capital management issues and strategies are

in light of the COVID-19 pandemic. discussed at the ALCO and later escalated with recommended action plans to the

respective risk management committees and Board.

Market Risk & Asset-Liability

Management The above market risk and ALM management process is governed by the Market

Risk Management Framework and Trading Book and Banking Book Policy Statement.

Market risk is defined as risk of losses

in on and off-balance sheet positions Rate of Return Risk

resulting from movements in market Rate of return risk refers to the variability of assets and liabilities arising from

rates, foreign exchange rates, and volatility of market benchmark rates which impact portfolios both in the trading

equity and commodity prices which and banking books. Such changes may adversely affect both earnings and economic

may adversely impact earnings and value.

capital positions.

The Bank uses various measurement tools and analyses to study the impact

The risk is inherent in the financial of market rate changes on earnings and balance sheet profile to manage the

instruments held in the Bank’s asset said exposure. These include earnings at risk, economic value of equity and

and liability portfolios. In the event repricing gap analysis. In addition, the value at risk approach is used to estimate

of market stress, these risks could the maximum potential loss of an investment portfolio over a specified time.

have a material impact on the Bank’s

financial performance due to changes Risk tolerance limits are built along these sensitivity measurements to manage and

in economic value based on varying mitigate the related risk exposures. The Bank actively manages the following rate

market conditions where one of the of return risks:

primary risks would be changes in the

levels of profit rates.

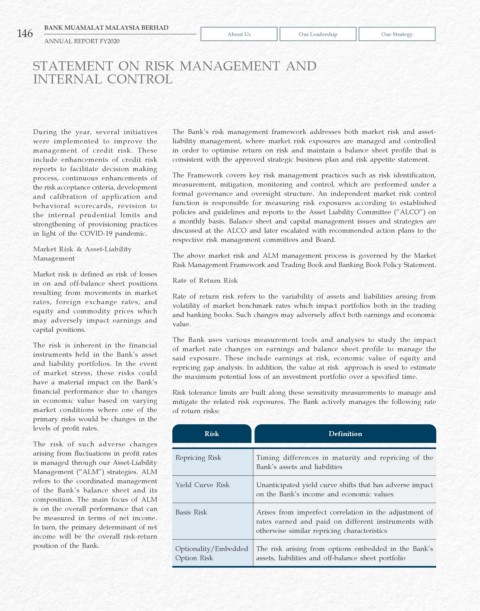

Risk Definition

The risk of such adverse changes

arising from fluctuations in profit rates Repricing Risk Timing differences in maturity and repricing of the

is managed through our Asset-Liability Bank’s assets and liabilities

Management (“ALM”) strategies. ALM

refers to the coordinated management Yield Curve Risk Unanticipated yield curve shifts that has adverse impact

of the Bank’s balance sheet and its on the Bank’s income and economic values

composition. The main focus of ALM

is on the overall performance that can Basis Risk Arises from imperfect correlation in the adjustment of

be measured in terms of net income. rates earned and paid on different instruments with

In turn, the primary determinant of net otherwise similar repricing characteristics

income will be the overall risk-return

position of the Bank. Optionality/Embedded The risk arising from options embedded in the Bank’s

Option Risk assets, liabilities and off-balance sheet portfolio