Page 412 - Bank-Muamalat_Annual-Report-2023

P. 412

BANK MUAMALAT MALAYSIA BERHAD

BASEL II

PILLAR 3 DISCLOSURE

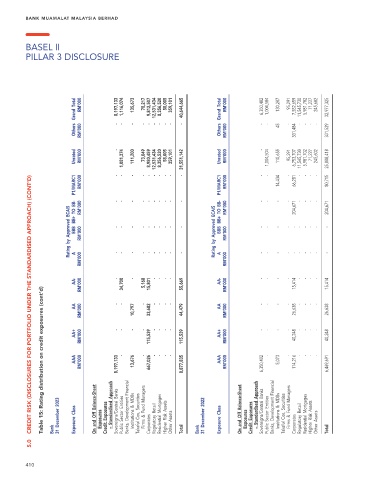

Others Grand Total RM’000 RM’000 8,197,133 - 1,116,074 - 135,673 - 78,217 - 9,812,507 - 12,531,434 - 8,356,520 - 58,005 - 359,101 - 40,644,665 - Others Grand Total RM’000 RM’000 6,350,402 - 1,004,504 - 130,207 45 95,291 - 7,552,659 331,484 11,545,730 - 5,981,702 - 71,227 - 245,602 - 32,977,325 331,529

Unrated RM’000 - 1,081,374 111,200 73,049 8,980,459 12,531,434 8,356,520 58,005 359,101 31,551,142 Unrated RM’000 - 1,004,504 110,655 95,291 6,753,707 11,545,730 5,981,702 71,227 245,602 25,808,418

P1/MARC1 RM’000 - - - - - - - - - - - - - - - - - - - - P1/MARC1 RM’000 - - - - 14,434 - - - 66,281 - - - - - - - - 80,715

CREDIT RISK (DISCLOSURES FOR PORTFOLIO UNDER THE STANDARDISED APPROACH) (CONT’D)

Rating by Approved ECAIS BB+ TO BB- BBB RM’000 RM’000 - - - - - - - - - - Rating by Approved ECAIS BB+ TO BB- BBB RM’000 RM’000 - - - - 204,671 - - - - - 204,671 -

RM’000 A - - - - - - - - - - A RM’000 - - - - - - - - - -

AA- RM’000 - 34,700 - 5,168 15,801 - - - - 55,669 AA- RM’000 - - - - 15,414 - - - - 15,414

Table 15: Rating distribution on credit exposures (cont’d)

AA - - - - - - - AA - - - - - - - -

RM’000 10,797 33,682 44,479 RM’000 26,638 26,638

AA+ RM’000 - - - - 115,539 - - - - 115,539 AA+ RM’000 - - - - 40,248 - - - - 40,248

AAA RM’000 8,197,133 - 13,676 - 667,026 - - - - 8,877,835 AAA RM’000 6,350,402 - 5,073 - 114,216 - - - - 6,469,691

31 December 2023 Exposure Class On and Off Balance-Sheet Exposures Credit Exposures – Standardised Approach Sovereigns/Central Banks Public Sector Entities Banks, Development Financial Institutions & MDBs Takaful Cos, Securities Firms & Fund Managers Regulatory Retail Residential Mortgages Higher Risk Assets Other Assets 31 December 2022 Exposure Class On and Off Balance-Sheet Exposures Credit Exposures – Standardised Approach Banks So

Bank Corporates Total Bank Public Firms Corporates Regulatory Residential Higher Other Total

5.0

410