Page 393 - Bank-Muamalat_Annual-Report-2023

P. 393

ANNUAL REPORT 2023

OUR NUMBERS

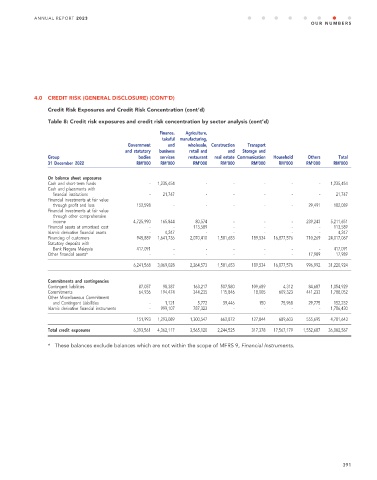

4.0 CREDIT RISK (GENERAL DISCLOSURE) (CONT’D)

Credit Risk Exposures and Credit Risk Concentration (cont’d)

Table 8: Credit risk exposures and credit risk concentration by sector analysis (cont’d)

Finance, Agriculture,

takaful manufacturing,

Government and wholesale, Construction Transport

and statutory business retail and and Storage and

Group bodies services restaurant real estate Communication Household Others Total

31 December 2022 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

On balance sheet exposures

Cash and short-term funds - 1,235,454 - - - - - 1,235,454

Cash and placements with

financial institutions - 21,747 - - - - - 21,747

Financial investments at fair value

through profit and loss 152,598 - - - - - 29,491 182,089

Financial investments at fair value

through other comprehensive

income 4,725,990 165,844 80,574 - - - 239,243 5,211,651

Financial assets at amortised cost - - 113,589 - - - - 113,589

Islamic derivative financial assets - 4,247 - - - - - 4,247

Financing of customers 945,889 1,641,736 2,070,410 1,581,653 189,534 16,877,576 710,269 24,017,067

Statutory deposits with

Bank Negara Malaysia 417,091 - - - - - - 417,091

Other financial assets* - - - - - - 17,989 17,989

6,241,568 3,069,028 2,264,573 1,581,653 189,534 16,877,576 996,992 31,220,924

Commitments and contingencies

Contingent liabilities 87,057 98,387 163,217 507,580 109,689 4,312 84,687 1,054,929

Commitments 64,936 194,474 344,235 115,846 18,005 609,323 441,233 1,788,052

Other Miscellaneous Commitment

and Contingent Liabilities - 1,121 5,772 39,446 150 75,968 29,775 152,232

Islamic derivative financial instruments - 999,107 787,323 - - - - 1,786,430

151,993 1,293,089 1,300,547 662,872 127,844 689,603 555,695 4,781,643

Total credit exposures 6,393,561 4,362,117 3,565,120 2,244,525 317,378 17,567,179 1,552,687 36,002,567

* These balances exclude balances which are not within the scope of MFRS 9, Financial Instruments.

391