Page 392 - Bank-Muamalat_Annual-Report-2023

P. 392

BANK MUAMALAT MALAYSIA BERHAD

BASEL II

PILLAR 3 DISCLOSURE

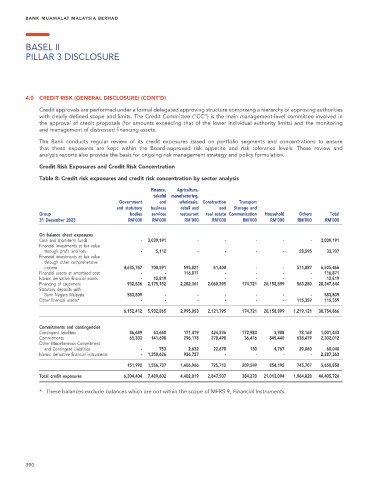

4.0 CREDIT RISK (GENERAL DISCLOSURE) (CONT’D)

Credit approvals are performed under a formal delegated approving structure comprising a hierarchy of approving authorities

with clearly defined scope and limits. The Credit Committee (“CC”) is the main management-level committee involved in

the approval of credit proposals (for amounts exceeding that of the lower individual authority limits) and the monitoring

and management of distressed financing assets.

The Bank conducts regular review of its credit exposures based on portfolio segments and concentrations to ensure

that these exposures are kept within the Board-approved risk appetite and risk tolerance levels. These review and

analysis reports also provide the basis for ongoing risk management strategy and policy formulation.

Credit Risk Exposures and Credit Risk Concentration

Table 8: Credit risk exposures and credit risk concentration by sector analysis

Finance, Agriculture,

takaful manufacturing,

Government and wholesale, Construction Transport

and statutory business retail and and Storage and

Group bodies services restaurant real estate Communication Household Others Total

31 December 2023 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

On balance sheet exposures

Cash and short-term funds - 3,039,191 - - - - - 3,039,191

Financial investments at fair value

through profit and loss - 5,112 - - - - 28,595 33,707

Financial investments at fair value

through other comprehensive

income 4,635,767 700,591 595,821 61,400 - - 511,887 6,505,466

Financial assets at amortised cost - - 116,871 - - - - 116,871

Islamic derivative financial assets - 12,819 - - - - - 12,819

Financing of customers 932,836 2,175,152 2,282,361 2,060,395 174,721 20,158,899 563,280 28,347,644

Statutory deposits with

Bank Negara Malaysia 583,809 - - - - - - 583,809

Other financial assets* - - - - - - 115,359 115,359

6,152,412 5,932,865 2,995,053 2,121,795 174,721 20,158,899 1,219,121 38,754,866

Commitments and contingencies

Contingent liabilities 86,689 63,660 171,419 424,536 172,983 3,988 78,168 1,001,443

Commitments 65,303 141,698 296,178 278,498 36,416 845,440 638,479 2,302,012

Other Miscellaneous Commitment

and Contingent Liabilities - 753 2,632 22,678 150 4,767 29,060 60,040

Islamic derivative financial instruments - 1,350,626 936,737 - - - - 2,287,363

151,992 1,556,737 1,406,966 725,712 209,549 854,195 745,707 5,650,858

Total credit exposures 6,304,404 7,489,602 4,402,019 2,847,507 384,270 21,013,094 1,964,828 44,405,724

* These balances exclude balances which are not within the scope of MFRS 9, Financial Instruments.

390