Page 387 - Bank-Muamalat_Annual-Report-2023

P. 387

ANNUAL REPORT 2023

OUR NUMBERS

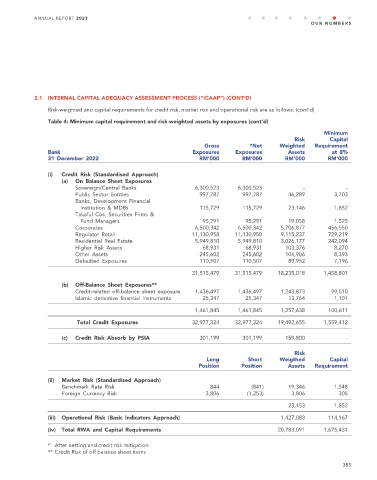

2.1 INTERNAL CAPITAL ADEQUACY ASSESSMENT PROCESS (“ICAAP”) (CONT’D)

Risk-weighted and capital requirements for credit risk, market risk and operational risk are as follows: (cont’d)

Table 4: Minimum capital requirement and risk-weighted assets by exposures (cont’d)

Minimum

Risk Capital

Gross *Net Weighted Requirement

Bank Exposures Exposures Assets at 8%

31 December 2022 RM’000 RM’000 RM’000 RM’000

(i) Credit Risk (Standardised Approach)

(a) On Balance Sheet Exposures

Sovereign/Central Banks 6,300,523 6,300,523 - -

Public Sector Entities 997,787 997,787 46,289 3,703

Banks, Development Financial

Institution & MDBs 115,729 115,729 23,146 1,852

Takaful Cos, Securities Firms &

Fund Managers 95,291 95,291 19,058 1,525

Corporates 6,500,342 6,500,342 5,706,877 456,550

Regulator Retail 11,130,958 11,130,958 9,115,237 729,219

Residential Real Estate 5,949,810 5,949,810 3,026,177 242,094

Higher Risk Assets 68,931 68,931 103,376 8,270

Other Assets 245,602 245,602 104,906 8,393

Defaulted Exposures 110,507 110,507 89,952 7,196

31,515,479 31,515,479 18,235,018 1,458,801

(b) Off-Balance Sheet Exposures**

Credit-related off-balance sheet exposure 1,436,497 1,436,497 1,243,873 99,510

Islamic derivative financial instruments 25,347 25,347 13,764 1,101

1,461,845 1,461,845 1,257,638 100,611

Total Credit Exposures 32,977,324 32,977,324 19,492,655 1,559,412

(c) Credit Risk Absorb by PSIA 301,199 301,199 159,800 -

Risk

Long Short Weigthed Capital

Position Position Assets Requirement

(ii) Market Risk (Standardised Approach)

Benchmark Rate Risk 844 (841) 19,346 1,548

Foreign Currency Risk 3,806 (1,253) 3,806 305

23,153 1,852

(iii) Operational Risk (Basic Indicators Approach) 1,427,083 114,167

(iv) Total RWA and Capital Requirements 20,783,091 1,675,431

* After netting and credit risk mitigation

** Credit Risk of off balance sheet items

385