Page 384 - Bank-Muamalat_Annual-Report-2023

P. 384

BANK MUAMALAT MALAYSIA BERHAD

BASEL II

PILLAR 3 DISCLOSURE

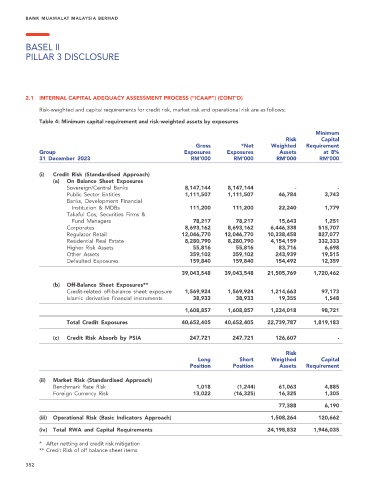

2.1 INTERNAL CAPITAL ADEQUACY ASSESSMENT PROCESS (“ICAAP”) (CONT’D)

Risk-weighted and capital requirements for credit risk, market risk and operational risk are as follows:

Table 4: Minimum capital requirement and risk-weighted assets by exposures

Minimum

Risk Capital

Gross *Net Weighted Requirement

Group Exposures Exposures Assets at 8%

31 December 2023 RM’000 RM’000 RM’000 RM’000

(i) Credit Risk (Standardised Approach)

(a) On Balance Sheet Exposures

Sovereign/Central Banks 8,147,144 8,147,144 - -

Public Sector Entities 1,111,507 1,111,507 46,784 3,743

Banks, Development Financial

Institution & MDBs 111,200 111,200 22,240 1,779

Takaful Cos, Securities Firms &

Fund Managers 78,217 78,217 15,643 1,251

Corporates 8,693,162 8,693,162 6,446,338 515,707

Regulator Retail 12,046,770 12,046,770 10,338,458 827,077

Residential Real Estate 8,280,790 8,280,790 4,154,159 332,333

Higher Risk Assets 55,816 55,816 83,716 6,698

Other Assets 359,102 359,102 243,939 19,515

Defaulted Exposures 159,840 159,840 154,492 12,359

39,043,548 39,043,548 21,505,769 1,720,462

(b) Off-Balance Sheet Exposures**

Credit-related off-balance sheet exposure 1,569,924 1,569,924 1,214,663 97,173

Islamic derivative financial instruments 38,933 38,933 19,355 1,548

1,608,857 1,608,857 1,234,018 98,721

Total Credit Exposures 40,652,405 40,652,405 22,739,787 1,819,183

(c) Credit Risk Absorb by PSIA 247,721 247,721 126,607 -

Risk

Long Short Weigthed Capital

Position Position Assets Requirement

(ii) Market Risk (Standardised Approach)

Benchmark Rate Risk 1,018 (1,244) 61,063 4,885

Foreign Currency Risk 13,022 (16,325) 16,325 1,305

77,388 6,190

(iii) Operational Risk (Basic Indicators Approach) 1,508,264 120,662

(iv) Total RWA and Capital Requirements 24,198,832 1,946,035

* After netting and credit risk mitigation

** Credit Risk of off balance sheet items

382