Page 383 - Bank-Muamalat_Annual-Report-2023

P. 383

ANNUAL REPORT 2023

OUR NUMBERS

2.1 INTERNAL CAPITAL ADEQUACY ASSESSMENT PROCESS (“ICAAP”) (CONT’D)

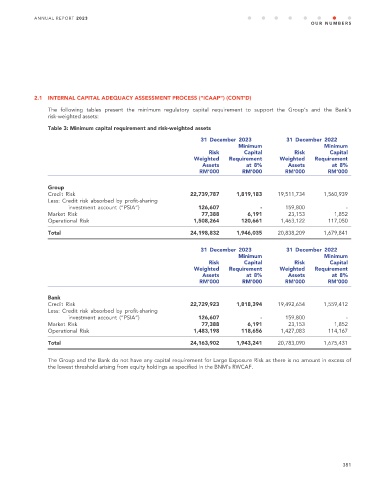

The following tables present the minimum regulatory capital requirement to support the Group’s and the Bank’s

risk-weighted assets:

Table 3: Minimum capital requirement and risk-weighted assets

31 December 2023 31 December 2022

Minimum Minimum

Risk Capital Risk Capital

Weighted Requirement Weighted Requirement

Assets at 8% Assets at 8%

RM’000 RM’000 RM’000 RM’000

Group

Credit Risk 22,739,787 1,819,183 19,511,734 1,560,939

Less: Credit risk absorbed by profit-sharing

investment account (“PSIA”) 126,607 - 159,800 -

Market Risk 77,388 6,191 23,153 1,852

Operational Risk 1,508,264 120,661 1,463,122 117,050

Total 24,198,832 1,946,035 20,838,209 1,679,841

31 December 2023 31 December 2022

Minimum Minimum

Risk Capital Risk Capital

Weighted Requirement Weighted Requirement

Assets at 8% Assets at 8%

RM’000 RM’000 RM’000 RM’000

Bank

Credit Risk 22,729,923 1,818,394 19,492,654 1,559,412

Less: Credit risk absorbed by profit-sharing

investment account (“PSIA”) 126,607 - 159,800 -

Market Risk 77,388 6,191 23,153 1,852

Operational Risk 1,483,198 118,656 1,427,083 114,167

Total 24,163,902 1,943,241 20,783,090 1,675,431

The Group and the Bank do not have any capital requirement for Large Exposure Risk as there is no amount in excess of

the lowest threshold arising from equity holdings as specified in the BNM’s RWCAF.

381