Page 340 - Bank-Muamalat_Annual-Report-2023

P. 340

BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2023 (18 JAMADIL AKHIR 1445H)

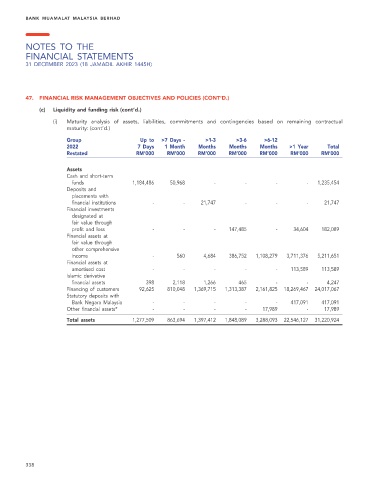

47. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

(c) Liquidity and funding risk (cont’d.)

(i) Maturity analysis of assets, liabilities, commitments and contingencies based on remaining contractual

maturity: (cont’d.)

Group Up to >7 Days - >1-3 >3-6 >6-12

2022 7 Days 1 Month Months Months Months >1 Year Total

Restated RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

Assets

Cash and short-term

funds 1,184,486 50,968 - - - - 1,235,454

Deposits and

placements with

financial institutions - - 21,747 - - - 21,747

Financial investments

designated at

fair value through

profit and loss - - - 147,485 - 34,604 182,089

Financial assets at

fair value through

other comprehensive

income - 560 4,684 386,752 1,108,279 3,711,376 5,211,651

Financial assets at

amortised cost - - - - - 113,589 113,589

Islamic derivative

financial assets 398 2,118 1,266 465 - - 4,247

Financing of customers 92,625 810,048 1,369,715 1,313,387 2,161,825 18,269,467 24,017,067

Statutory deposits with

Bank Negara Malaysia - - - - - 417,091 417,091

Other financial assets* - - - - 17,989 - 17,989

Total assets 1,277,509 863,694 1,397,412 1,848,089 3,288,093 22,546,127 31,220,924

338