Page 338 - Bank-Muamalat_Annual-Report-2023

P. 338

BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2023 (18 JAMADIL AKHIR 1445H)

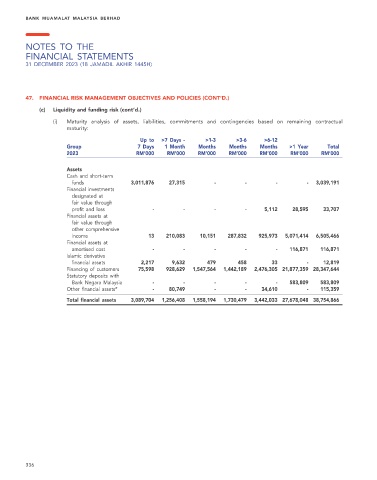

47. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

(c) Liquidity and funding risk (cont’d.)

(i) Maturity analysis of assets, liabilities, commitments and contingencies based on remaining contractual

maturity:

Up to >7 Days - >1-3 >3-6 >6-12

Group 7 Days 1 Month Months Months Months >1 Year Total

2023 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

Assets

Cash and short-term

funds 3,011,876 27,315 - - - - 3,039,191

Financial investments

designated at

fair value through

profit and loss - - - - 5,112 28,595 33,707

Financial assets at

fair value through

other comprehensive

income 13 210,083 10,151 287,832 925,973 5,071,414 6,505,466

Financial assets at

amortised cost - - - - - 116,871 116,871

Islamic derivative

financial assets 2,217 9,632 479 458 33 - 12,819

Financing of customers 75,598 928,629 1,547,564 1,442,189 2,476,305 21,877,359 28,347,644

Statutory deposits with

Bank Negara Malaysia - - - - - 583,809 583,809

Other financial assets* - 80,749 - - 34,610 - 115,359

Total financial assets 3,089,704 1,256,408 1,558,194 1,730,479 3,442,033 27,678,048 38,754,866

336