Page 264 - Bank-Muamalat_Annual-Report-2023

P. 264

BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2023 (18 JAMADIL AKHIR 1445H)

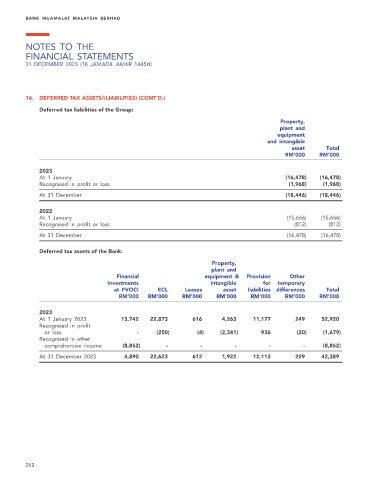

16. DEFERRED TAX ASSETS/(LIABILITIES) (CONT’D.)

Deferred tax liabilities of the Group:

Property,

plant and

equipment

and intangible

asset Total

RM’000 RM’000

2023

At 1 January (16,478) (16,478)

Recognised in profit or loss (1,968) (1,968)

At 31 December (18,446) (18,446)

2022

At 1 January (15,666) (15,666)

Recognised in profit or loss (812) (812)

At 31 December (16,478) (16,478)

Deferred tax assets of the Bank:

Property,

plant and

Financial equipment & Provision Other

Investments intangible for temporary

at FVOCI ECL Leases asset liabilities differences Total

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

2023

At 1 January 2023 13,742 22,873 616 4,263 11,177 249 52,920

Recognised in profit

or loss - (250) (4) (2,341) 936 (20) (1,679)

Recognised in other

comprehensive income (8,852) - - - - - (8,852)

At 31 December 2023 4,890 22,623 612 1,922 12,113 229 42,389

262