Page 263 - Bank-Muamalat_Annual-Report-2023

P. 263

ANNUAL REPORT 2023

OUR NUMBERS

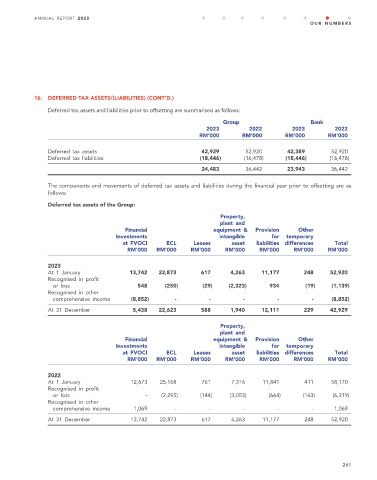

16. DEFERRED TAX ASSETS/(LIABILITIES) (CONT’D.)

Deferred tax assets and liabilities prior to offsetting are summarised as follows:

Group Bank

2023 2022 2023 2022

RM’000 RM’000 RM’000 RM’000

Deferred tax assets 42,929 52,920 42,389 52,920

Deferred tax liabilities (18,446) (16,478) (18,446) (16,478)

24,483 36,442 23,943 36,442

The components and movements of deferred tax assets and liabilities during the financial year prior to offsetting are as

follows:

Deferred tax assets of the Group:

Property,

plant and

Financial equipment & Provision Other

Investments intangible for temporary

at FVOCI ECL Leases asset liabilities differences Total

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

2023

At 1 January 13,742 22,873 617 4,263 11,177 248 52,920

Recognised in profit

or loss 548 (250) (29) (2,323) 934 (19) (1,139)

Recognised in other

comprehensive income (8,852) - - - - - (8,852)

At 31 December 5,438 22,623 588 1,940 12,111 229 42,929

Property,

plant and

Financial equipment & Provision Other

Investments intangible for temporary

at FVOCI ECL Leases asset liabilities differences Total

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

2022

At 1 January 12,673 25,168 761 7,316 11,841 411 58,170

Recognised in profit

or loss - (2,295) (144) (3,053) (664) (163) (6,319)

Recognised in other

comprehensive income 1,069 - - - - - 1,069

At 31 December 13,742 22,873 617 4,263 11,177 248 52,920

261