Page 260 - Bank-Muamalat_Annual-Report-2023

P. 260

BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2023 (18 JAMADIL AKHIR 1445H)

15. LEASES

15.1 Group and the Bank as a lessee

The Group and the Bank have leases for leasehold land, building and office equipment. Lease contracts are typically

made for fixed periods of one (1) to three (3) years, but may have extension options.

With the exception of short-term leases and leases of low-value underlying assets, each lease is reflected on the

statements of financial position as a right-of-use asset and a lease liability.

Leases are either non-cancellable or may only be cancelled by incurring a substantive termination fee. Some leases

contain an option to extend the lease for a further term.

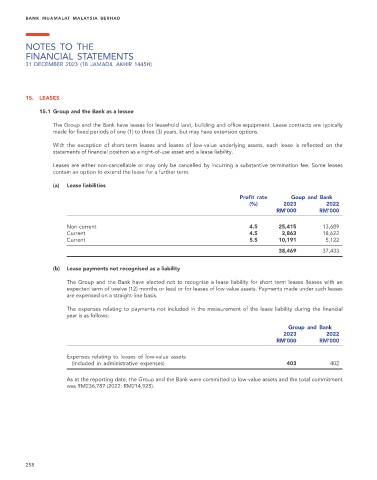

(a) Lease liabilities

Profit rate Goup and Bank

(%) 2023 2022

RM’000 RM’000

Non-current 4.5 25,415 13,689

Current 4.5 2,863 18,622

Current 5.5 10,191 5,122

38,469 37,433

(b) Lease payments not recognised as a liability

The Group and the Bank have elected not to recognise a lease liability for short term leases (leases with an

expected term of twelve (12) months or less) or for leases of low value assets. Payments made under such leases

are expensed on a straight-line basis.

The expenses relating to payments not included in the measurement of the lease liability during the financial

year is as follows:

Group and Bank

2023 2022

RM’000 RM’000

Expenses relating to leases of low-value assets

(included in administrative expenses) 403 402

As at the reporting date, the Group and the Bank were committed to low-value assets and the total commitment

was RM236,787 (2022: RM214,925).

258