Page 262 - Bank-Muamalat_Annual-Report-2023

P. 262

BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2023 (18 JAMADIL AKHIR 1445H)

15. LEASES (CONT’D.)

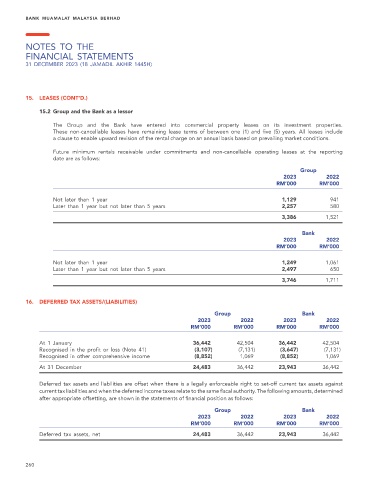

15.2 Group and the Bank as a lessor

The Group and the Bank have entered into commercial property leases on its investment properties.

These non-cancellable leases have remaining lease terms of between one (1) and five (5) years. All leases include

a clause to enable upward revision of the rental charge on an annual basis based on prevailing market conditions.

Future minimum rentals receivable under commitments and non-cancellable operating leases at the reporting

date are as follows:

Group

2023 2022

RM’000 RM’000

Not later than 1 year 1,129 941

Later than 1 year but not later than 5 years 2,257 580

3,386 1,521

Bank

2023 2022

RM’000 RM’000

Not later than 1 year 1,249 1,061

Later than 1 year but not later than 5 years 2,497 650

3,746 1,711

16. DEFERRED TAX ASSETS/(LIABILITIES)

Group Bank

2023 2022 2023 2022

RM’000 RM’000 RM’000 RM’000

At 1 January 36,442 42,504 36,442 42,504

Recognised in the profit or loss (Note 41) (3,107) (7,131) (3,647) (7,131)

Recognised in other comprehensive income (8,852) 1,069 (8,852) 1,069

At 31 December 24,483 36,442 23,943 36,442

Deferred tax assets and liabilities are offset when there is a legally enforceable right to set-off current tax assets against

current tax liabilities and when the deferred income taxes relate to the same fiscal authority. The following amounts, determined

after appropriate offsetting, are shown in the statements of financial position as follows:

Group Bank

2023 2022 2023 2022

RM’000 RM’000 RM’000 RM’000

Deferred tax assets, net 24,483 36,442 23,943 36,442

260