Page 13 - Bank-Muamalat_Annual-Report-2023

P. 13

ANNUAL REPORT 2023

OVERVIEW

5 YEARS FINANCIAL

HIGHLIGHTS

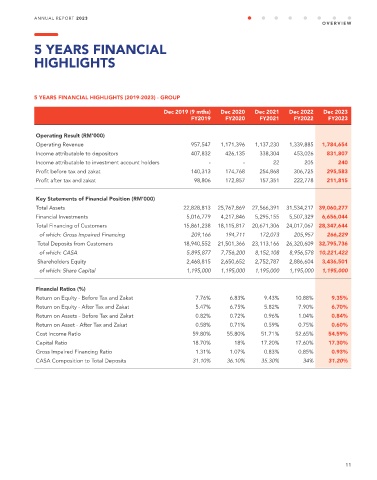

5 YEARS FINANCIAL HIGHLIGHTS (2019-2023) - GROUP

Dec 2019 (9 mths) Dec 2020 Dec 2021 Dec 2022 Dec 2023

FY2019 FY2020 FY2021 FY2022 FY2023

Operating Result (RM’000)

Operating Revenue 957,547 1,171,396 1,137,230 1,339,885 1,784,654

Income attributable to depositors 407,832 426,135 338,304 453,026 831,807

Income attributable to investment account holders - - 22 205 240

Profit before tax and zakat 140,313 174,768 254,868 306,725 295,583

Profit after tax and zakat 98,806 172,857 157,351 222,778 211,815

Key Statements of Financial Position (RM’000)

Total Assets 22,828,813 25,767,869 27,566,391 31,534,217 39,060,277

Financial Investments 5,016,779 4,217,846 5,295,155 5,507,329 6,656,044

Total Financing of Customers 15,861,238 18,115,817 20,671,306 24,017,067 28,347,644

of which: Gross Impaired Financing 209,166 194,711 172,073 205,957 266,229

Total Deposits from Customers 18,940,552 21,501,366 23,113,166 26,320,609 32,795,736

of which: CASA 5,895,877 7,756,200 8,152,108 8,956,578 10,221,422

Shareholders Equity 2,468,815 2,650,652 2,752,787 2,886,604 3,436,501

of which: Share Capital 1,195,000 1,195,000 1,195,000 1,195,000 1,195,000

Financial Ratios (%)

Return on Equity - Before Tax and Zakat 7.76% 6.83% 9.43% 10.88% 9.35%

Return on Equity - After Tax and Zakat 5.47% 6.75% 5.82% 7.90% 6.70%

Return on Assets - Before Tax and Zakat 0.82% 0.72% 0.96% 1.04% 0.84%

Return on Asset - After Tax and Zakat 0.58% 0.71% 0.59% 0.75% 0.60%

Cost Income Ratio 59.80% 55.80% 51.71% 52.65% 54.59%

Capital Ratio 18.70% 18% 17.20% 17.60% 17.30%

Gross Impaired Financing Ratio 1.31% 1.07% 0.83% 0.85% 0.93%

CASA Composition to Total Deposits 31.10% 36.10% 35.30% 34% 31.20%

11