Page 15 - Bank-Muamalat_Annual-Report-2023

P. 15

ANNUAL REPORT 2023

OVERVIEW

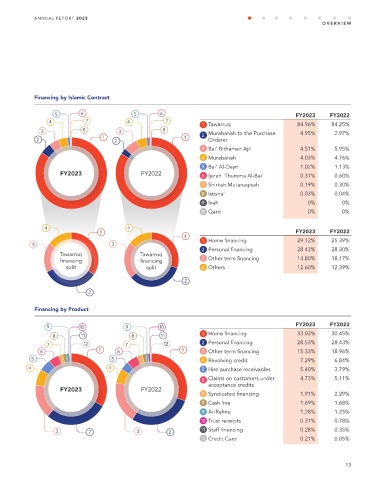

Financing by Islamic Contract

5 6 5 6 FY2023 FY2022

4 7 4 7

1 Tawarruq 84.96% 84.25%

3 8 3 8 Murabahah to the Purchase 4.95% 2.97%

1 1 2

2 2 Orderer

3 Bai’ Bithaman Ajil 4.51% 5.95%

4 Murabahah 4.03% 4.76%

5 Bai’ Al-Dayn 1.02% 1.13%

FY2023 FY2022 6 Ijarah Thumma Al-Bai' 0.31% 0.60%

7 Shirkah Mutanaqisah 0.19% 0.30%

8 Istisna’ 0.03% 0.04%

9 Inah 0% 0%

10 Qard 0% 0%

4 4

1 FY2023 FY2022

1

1 Home financing 29.12% 25.39%

3 3

2 Personal financing 28.43% 28.30%

Tawarruq Tawarruq

financing financing 3 Other term financing 14.80% 18.17%

split split 4 Others 12.60% 12.39%

2

2

Financing by Product

FY2023 FY2022

9 10 9 10

8 11 8 11 1 Home financing 33.03% 30.45%

7 12 7 12 2 Personal financing 28.53% 28.43%

6 1 6 1 3 Other term financing 15.33% 18.96%

5 5 4. Revolving credit 7.29% 6.84%

4

4 4 5. Hire purchase receivables 5.40% 3.79%

5

6 Claims on customers under 4.73% 5.11%

acceptance credits

FY2023 FY2022

7 Syndicated financing 1.91% 2.29%

8 Cash line 1.69% 1.68%

9 Ar-Rahnu 1.28% 1.25%

10 Trust receipts 0.31% 0.78%

3 2 3 2 11 Staff financing 0.28% 0.35%

12 Credit Card 0.21% 0.05%

13