Page 16 - Bank-Muamalat_Annual-Report-2023

P. 16

BANK MUAMALAT MALAYSIA BERHAD

ASSETS

PERFORMANCE

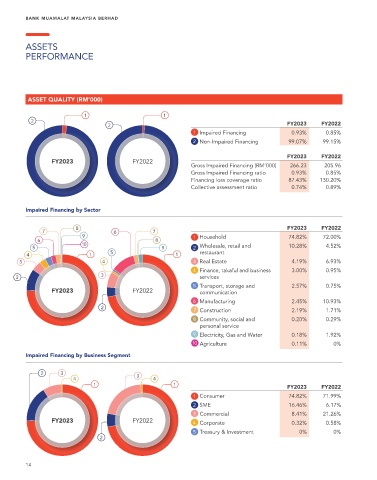

ASSET QUALITY (RM’000)

1 1

2

2 FY2023 FY2022

1 Impaired Financing 0.93% 0.85%

2 Non-Impaired Financing 99.07% 99.15%

FY2023 FY2022

FY2023 FY2022

Gross Impaired Financing (RM’000) 266.23 205.96

Gross Impaired Financing ratio 0.93% 0.85%

Financing loss coverage ratio 87.43% 130.20%

Collective assessment ratio 0.74% 0.89%

Impaired Financing by Sector

8 FY2023 FY2022

7 6 7

9 1 Household 74.82% 72.00%

6 8

10 Wholesale, retail and 10.28% 4.52%

5 9 2

5 restaurant

4 1 1

3 4 3 Real Estate 4.19% 6.93%

4 Finance, takaful and business 3.00% 0.95%

3

2 services

5 Transport, storage and 2.57% 0.75%

FY2023 FY2022 communication

6 Manufacturing 2.45% 10.93%

2

7 Construction 2.19% 1.71%

8 Community, social and 0.20% 0.29%

personal service

9 Electricity, Gas and Water 0.18% 1.92%

10 Agriculture 0.11% 0%

Impaired Financing by Business Segment

2 3 3

4 4

1 1

FY2023 FY2022

1 Consumer 74.82% 71.99%

2 SME 16.46% 6.17%

3 Commercial 8.41% 21.26%

FY2023 FY2022 4 Corporate 0.32% 0.58%

5 Treasury & Investment 0% 0%

2

14