Page 8 - Bank-Muamalat-Annual-Report-2021

P. 8

6 BANK MUAMALAT MALAYSIA BERHAD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

ABOUT

BANK MUAMALAT

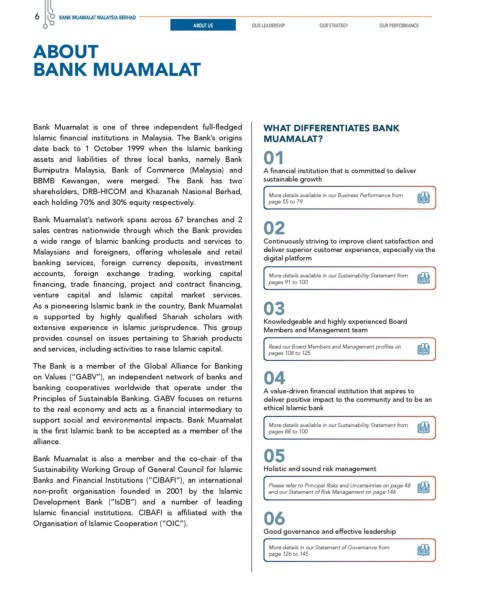

Bank Muamalat is one of three independent full-fledged WHAT DIFFERENTIATES BANK

Islamic financial institutions in Malaysia. The Bank’s origins MUAMALAT?

date back to 1 October 1999 when the Islamic banking

assets and liabilities of three local banks, namely Bank 01

Bumiputra Malaysia, Bank of Commerce (Malaysia) and A financial institution that is committed to deliver

BBMB Kewangan, were merged. The Bank has two sustainable growth

shareholders, DRB-HICOM and Khazanah Nasional Berhad,

More details available in our Business Performance from

each holding 70% and 30% equity respectively. page 55 to 79

Bank Muamalat’s network spans across 67 branches and 2

sales centres nationwide through which the Bank provides 02

a wide range of Islamic banking products and services to Continuously striving to improve client satisfaction and

Malaysians and foreigners, offering wholesale and retail deliver superior customer experience, especially via the

digital platform

banking services, foreign currency deposits, investment

accounts, foreign exchange trading, working capital More details available in our Sustainability Statement from

financing, trade financing, project and contract financing, pages 91 to 100

venture capital and Islamic capital market services.

As a pioneering Islamic bank in the country, Bank Muamalat 03

is supported by highly qualified Shariah scholars with

Knowledgeable and highly experienced Board

extensive experience in Islamic jurisprudence. This group Members and Management team

provides counsel on issues pertaining to Shariah products

and services, including activities to raise Islamic capital. Read our Board Members and Management profiles on

pages 108 to 125

The Bank is a member of the Global Alliance for Banking

on Values (“GABV”), an independent network of banks and 04

banking cooperatives worldwide that operate under the

A value-driven financial institution that aspires to

Principles of Sustainable Banking. GABV focuses on returns deliver positive impact to the community and to be an

to the real economy and acts as a financial intermediary to ethical Islamic bank

support social and environmental impacts. Bank Muamalat

More details available in our Sustainability Statement from

is the first Islamic bank to be accepted as a member of the pages 88 to 100

alliance.

05

Bank Muamalat is also a member and the co-chair of the

Sustainability Working Group of General Council for Islamic Holistic and sound risk management

Banks and Financial Institutions (“CIBAFI”), an international

Please refer to Principal Risks and Uncertainties on page 48

non-profit organisation founded in 2001 by the Islamic and our Statement of Risk Management on page 146

Development Bank (“IsDB”) and a number of leading

Islamic financial institutions. CIBAFI is affiliated with the 06

Organisation of Islamic Cooperation (“OIC”).

Good governance and effective leadership

More details in our Statement of Governance from

page 126 to 145