Page 394 - Bank-Muamalat-Annual-Report-2021

P. 394

392 BANK MUAMALAT MALAYSIA BERHAD

OUR LEADERSHIP

OUR STRA

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

ABOUT US

TEGY

OUR PERFORMANCE

BASEL II

PILLAR 3 DISCLOSURE

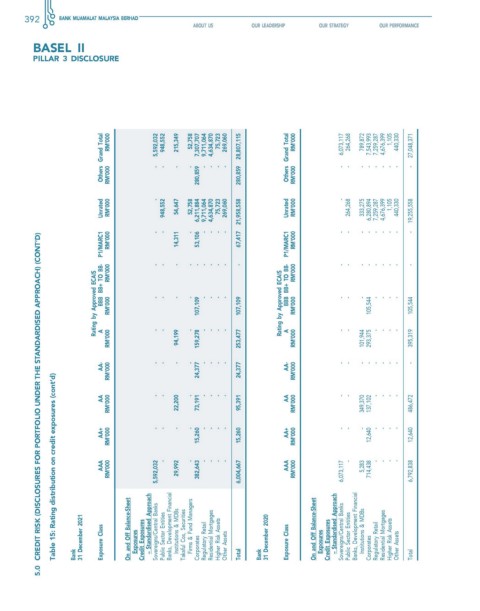

others grand Total rM’000 rM’000 5,592,032 - 948,552 - 215,349 - 52,758 - 7,307,707 280,859 9,711,064 - 4,634,870 - 75,723 - 269,060 - 280,859 28,807,115 others grand Total rM’000 rM’000 6,073,117 - 264,268 - 789,872 - 7,543,993 - 7,259,287 - 4,676,399 - 1,105 - 440,330 - 27,048,371 -

unrated rM’000 - 948,552 54,647 52,758 6,211,884 9,711,064 4,634,870 75,723 269,060 67,417 21,958,558 unrated rM’000 - 264,268 333,275 6,280,894 7,259,287 4,676,399 1,105 440,330 19,255,558

P1/MArc1 rM’000 rM’000 - - - - 14,311 - - - 53,106 - - - - - - - - - - P1/MArc1 rM’000 rM’000 - - - - - - - - - - - - - - - - - -

5.0 creDIT rIsK (DIsclosures for PorTfolIo unDer The sTAnDArDIseD APProAch) (conT’D)

rating by Approved ecAIs BB+ To BB- BBB rM’000 - - - - 107,109 - - - - 107,109 rating by Approved ecAIs BB+ To BB- BBB rM’000 - - - 105,544 - - - - 105,544

rM’000 A - - 94,199 - 159,278 - - - - 253,477 A rM’000 - - 101,944 293,375 - - - - 395,319

AA- - - - - - - - - 24,377 AA- - - - - - - - - -

rM’000 24,377 rM’000

Table 15: rating distribution on credit exposures (cont’d)

AA - - - - - - - AA - - - - - -

rM’000 22,200 73,191 95,391 rM’000 349,370 137,102 486,472

AA+ rM’000 - - - - 15,260 - - - - 15,260 AA+ rM’000 - - - 12,640 - - - - 12,640

AAA rM’000 5,592,032 - 29,992 - 382,643 - - - - 6,004,667 AAA rM’000 6,073,117 - 5,283 714,438 - - - - 6,792,838

31 December 2021 exposure class on and off Balance-sheet exposures credit exposures – standardised Approach Sovereigns/Central Banks Public Sector Entities Banks, Development Financial Institutions & MDBs Takaful Cos, Securities Firms & Fund Managers Regulatory Retail Residential Mortgages Higher Risk Assets Other Assets 31 December 2020 exposure class on and off Balance-sheet exposures credit exposures – standardised Approach Sovereig

Bank Corporates Total Bank Corporates Total