Page 244 - Bank-Muamalat-Annual-Report-2021

P. 244

242 bank MuaMalat Malaysia berhaD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

15. LeAses

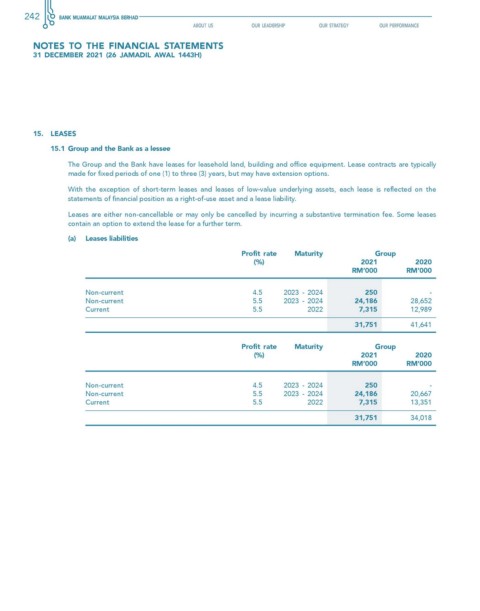

15.1 Group and the Bank as a lessee

The Group and the Bank have leases for leasehold land, building and office equipment. Lease contracts are typically

made for fixed periods of one (1) to three (3) years, but may have extension options.

With the exception of short-term leases and leases of low-value underlying assets, each lease is reflected on the

statements of financial position as a right-of-use asset and a lease liability.

Leases are either non-cancellable or may only be cancelled by incurring a substantive termination fee. Some leases

contain an option to extend the lease for a further term.

(a) Leases liabilities

Profit rate Maturity Group

(%) 2021 2020

rM’000 rM’000

Non-current 4.5 2023 - 2024 250 -

Non-current 5.5 2023 - 2024 24,186 28,652

Current 5.5 2022 7,315 12,989

31,751 41,641

Profit rate Maturity Group

(%) 2021 2020

rM’000 rM’000

Non-current 4.5 2023 - 2024 250 -

Non-current 5.5 2023 - 2024 24,186 20,667

Current 5.5 2022 7,315 13,351

31,751 34,018