Page 249 - Bank-Muamalat-Annual-Report-2021

P. 249

ANNUAL REPORT 2021 247

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

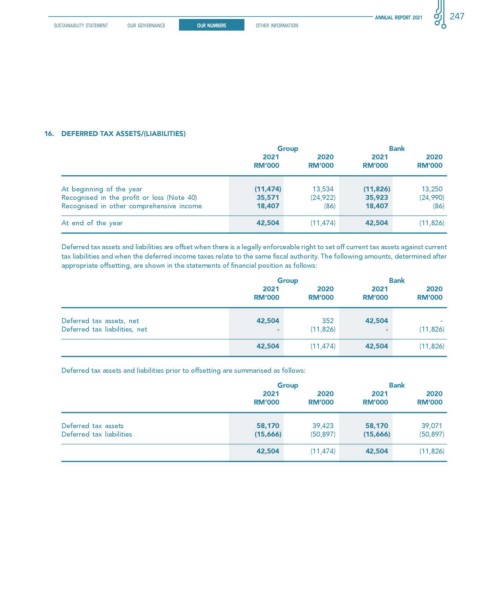

16. DefeRReD TAx AsseTs/(LIABILITIes)

Group Bank

2021 2020 2021 2020

rM’000 rM’000 rM’000 rM’000

At beginning of the year (11,474) 13,534 (11,826) 13,250

Recognised in the profit or loss (Note 40) 35,571 (24,922) 35,923 (24,990)

Recognised in other comprehensive income 18,407 (86) 18,407 (86)

At end of the year 42,504 (11,474) 42,504 (11,826)

Deferred tax assets and liabilities are offset when there is a legally enforceable right to set off current tax assets against current

tax liabilities and when the deferred income taxes relate to the same fiscal authority. The following amounts, determined after

appropriate offsetting, are shown in the statements of financial position as follows:

Group Bank

2021 2020 2021 2020

rM’000 rM’000 rM’000 rM’000

Deferred tax assets, net 42,504 352 42,504 -

Deferred tax liabilities, net - (11,826) - (11,826)

42,504 (11,474) 42,504 (11,826)

Deferred tax assets and liabilities prior to offsetting are summarised as follows:

Group Bank

2021 2020 2021 2020

rM’000 rM’000 rM’000 rM’000

Deferred tax assets 58,170 39,423 58,170 39,071

Deferred tax liabilities (15,666) (50,897) (15,666) (50,897)

42,504 (11,474) 42,504 (11,826)