Page 217 - Bank-Muamalat-Annual-Report-2021

P. 217

ANNUAL REPORT 2021 215

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

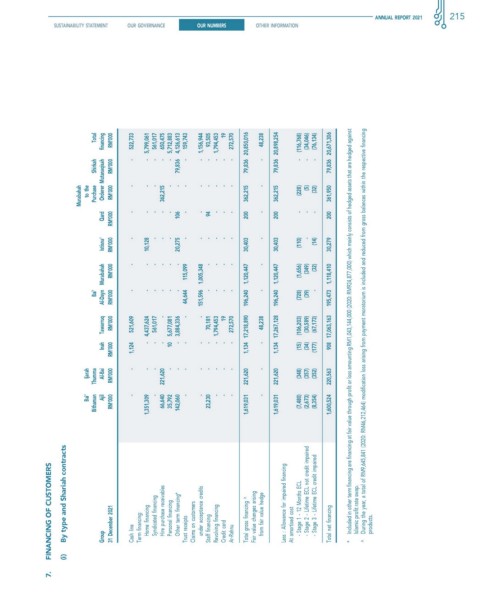

Total financing RM’000 522,733 - 5,799,061 561,017 650,475 - 5,712,883 159,743 - 1,156,944 93,505 - 1,794,453 19 272,570 48,238 - (116,768) (34,046) (76,134)

shirkah Orderer Mutanaqisah RM’000 - - - 79,836 4,126,613 - - - - 79,836 20,850,016 - 79,836 20,898,254 - - 79,836 20,671,306

Murabahah to the Purchase RM’000 - - - 362,215 - - - - - - - - 362,215 - 362,215 (228) (5) (32) 361,950

- - - - - - - - - - - - - -

Qard RM’000 106 94 200 200 200

- - - - - - - - - - - -

Istisna’ RM’000 10,128 20,275 30,403 30,403 (110) (14) 30,279

Murabahah RM’000 115,099 1,120,447 (1,656) (349)

- - - - - - - - - - - (32)

- - - - - - 151,596 1,005,348 - - - - - 196,240 1,120,447 - 195,473 1,118,410

Bai’ Al-Dayn RM’000 44,644 196,240 (728) (39)

- - - 19

Tawarruq RM’000 521,609 - 4,437,624 561,017 10 5,677,081 - 3,884,336 70,181 - 1,794,453 272,570 48,238 (106,203) (30,589) (67,173) 908 17,063,163 Included in other term financing are financing at fair value through profit or loss amounting RM1,043,144,000 (2020: RM924,877,000) which mainly consists of hedged assets that are hedged against During the year, a total of RM9,645,841 (2020: RM46,212,464) m

Inah RM’000 1,124 (15) (34) (177)

- - - - - - - 1,134 17,218,890 - 1,134 17,267,128

Ijarah Thumma Al-Bai RM’000 - - - 221,620 - - - - - - - - 221,620 - 221,620 (348) (357) (352) 220,563

Bai’ Ajil - - 66,640 35,792 - - 23,230 - - - -

Bithaman RM’000 1,351,309 142,060 1,619,031 1,619,031 (7,480) (2,673) (8,354) 1,600,524

fINANcING Of cusTOMeRs By type and shariah contracts Group 31 December 2021 Cash line Term financing: Home financing Syndicated financing Hire purchase receivables Personal financing Other term financing* Trust receipts Claims on customers under acceptance credits Staff financing Revolving financing Credit card Ar-Rahnu Total gross financing ^ Fair value changes arising from fair value hedge Less : Allowance for impaired fina

7. (i)