Page 179 - Bank-Muamalat-Annual-Report-2021

P. 179

ANNUAL REPORT 2021 177

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

Group Bank

2021 2020 2021 2020

note rM’000 rM’000 rM’000 rM’000

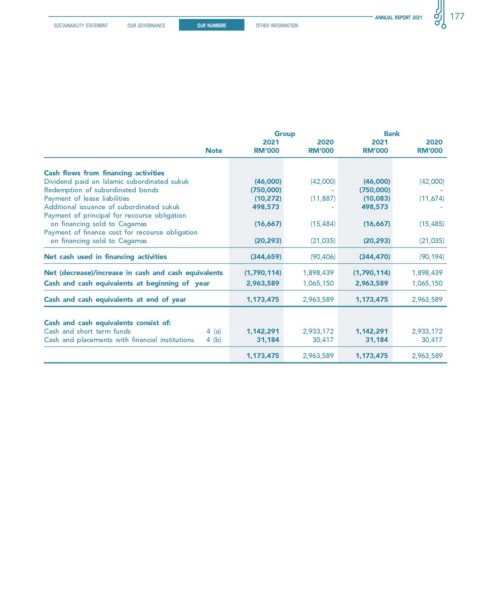

cash flows from financing activities

Dividend paid on Islamic subordinated sukuk (46,000) (42,000) (46,000) (42,000)

Redemption of subordinated bonds (750,000) - (750,000) -

Payment of lease liabilities (10,272) (11,887) (10,083) (11,674)

Additional issuance of subordinated sukuk 498,573 - 498,573 -

Payment of principal for recourse obligation

on financing sold to Cagamas (16,667) (15,484) (16,667) (15,485)

Payment of finance cost for recourse obligation

on financing sold to Cagamas (20,293) (21,035) (20,293) (21,035)

Net cash used in financing activities (344,659) (90,406) (344,470) (90,194)

Net (decrease)/increase in cash and cash equivalents (1,790,114) 1,898,439 (1,790,114) 1,898,439

cash and cash equivalents at beginning of year 2,963,589 1,065,150 2,963,589 1,065,150

cash and cash equivalents at end of year 1,173,475 2,963,589 1,173,475 2,963,589

cash and cash equivalents consist of:

Cash and short term funds 4 (a) 1,142,291 2,933,172 1,142,291 2,933,172

Cash and placements with financial institutions 4 (b) 31,184 30,417 31,184 30,417

1,173,475 2,963,589 1,173,475 2,963,589