Page 292 - Bank-Muamalat-AR2020

P. 292

290 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

Notes to the fiNaNcial statemeNts

31 December 2020 (16 JamaDil awal 1442h)

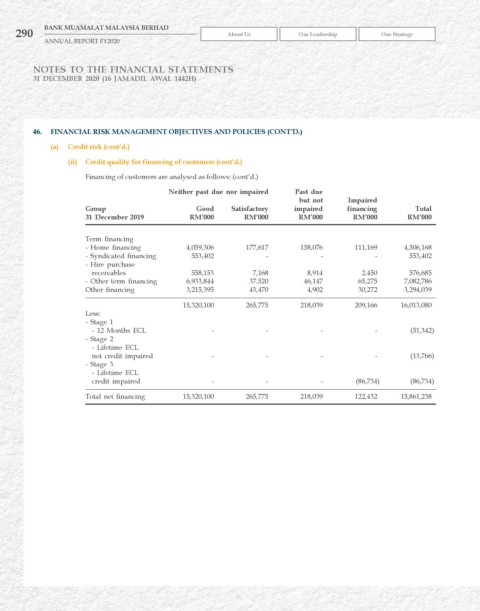

46. FINANCIAL rISk MANAGEMENT OBJECTIvES AND POLICIES (CONT’D.)

(a) Credit risk (cont’d.)

(ii) Credit quality for financing of customers (cont’d.)

Financing of customers are analysed as follows: (cont’d.)

Neither past due nor impaired Past due

but not Impaired

Group Good Satisfactory impaired financing Total

31 December 2019 rM’000 rM’000 rM’000 rM’000 rM’000

Term financing

- Home financing 4,059,306 177,617 158,076 111,169 4,506,168

- Syndicated financing 553,402 - - - 553,402

- Hire purchase

receivables 558,153 7,168 8,914 2,450 576,685

- Other term financing 6,933,844 37,520 46,147 65,275 7,082,786

Other financing 3,215,395 43,470 4,902 30,272 3,294,039

15,320,100 265,775 218,039 209,166 16,013,080

Less:

- Stage 1

- 12 Months ECL - - - - (51,342)

- Stage 2

- Lifetime ECL

not credit impaired - - - - (13,766)

- Stage 3

- Lifetime ECL

credit impaired - - - (86,734) (86,734)

Total net financing 15,320,100 265,775 218,039 122,432 15,861,238