Page 251 - Bank-Muamalat-AR2020

P. 251

249

Our Performance Sustainability Statement Governance Our Numbers Other Information

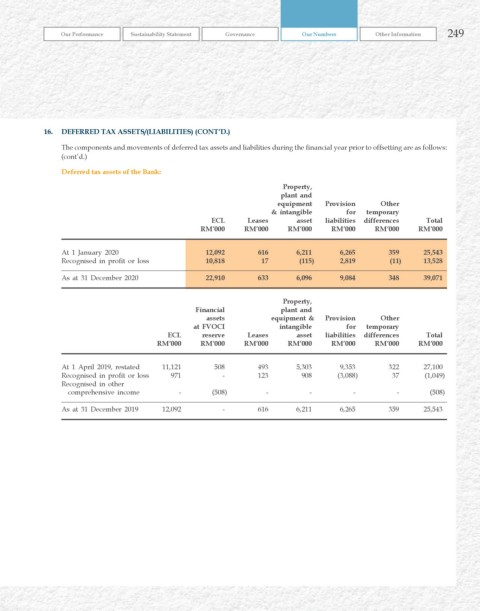

16. DEFErrED TAx ASSETS/(LIABILITIES) (CONT’D.)

The components and movements of deferred tax assets and liabilities during the financial year prior to offsetting are as follows:

(cont’d.)

Deferred tax assets of the Bank:

Property,

plant and

equipment Provision Other

& intangible for temporary

ECL Leases asset liabilities differences Total

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

At 1 January 2020 12,092 616 6,211 6,265 359 25,543

Recognised in profit or loss 10,818 17 (115) 2,819 (11) 13,528

As at 31 December 2020 22,910 633 6,096 9,084 348 39,071

Property,

Financial plant and

assets equipment & Provision Other

at FvOCI intangible for temporary

ECL reserve Leases asset liabilities differences Total

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

At 1 April 2019, restated 11,121 508 493 5,303 9,353 322 27,100

Recognised in profit or loss 971 - 123 908 (3,088) 37 (1,049)

Recognised in other

comprehensive income - (508) - - - - (508)

As at 31 December 2019 12,092 - 616 6,211 6,265 359 25,543