Page 249 - Bank-Muamalat-AR2020

P. 249

247

Our Performance Sustainability Statement Governance Our Numbers Other Information

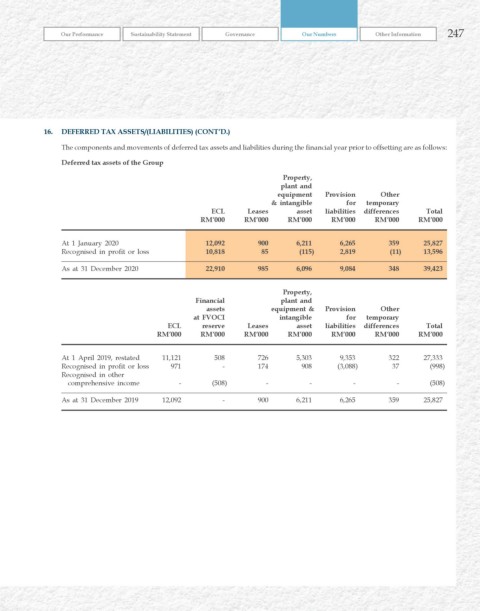

16. DEFErrED TAx ASSETS/(LIABILITIES) (CONT’D.)

The components and movements of deferred tax assets and liabilities during the financial year prior to offsetting are as follows:

Deferred tax assets of the Group

Property,

plant and

equipment Provision Other

& intangible for temporary

ECL Leases asset liabilities differences Total

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

At 1 January 2020 12,092 900 6,211 6,265 359 25,827

Recognised in profit or loss 10,818 85 (115) 2,819 (11) 13,596

As at 31 December 2020 22,910 985 6,096 9,084 348 39,423

Property,

Financial plant and

assets equipment & Provision Other

at FvOCI intangible for temporary

ECL reserve Leases asset liabilities differences Total

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

At 1 April 2019, restated 11,121 508 726 5,303 9,353 322 27,333

Recognised in profit or loss 971 - 174 908 (3,088) 37 (998)

Recognised in other

comprehensive income - (508) - - - - (508)

As at 31 December 2019 12,092 - 900 6,211 6,265 359 25,827