Page 180 - Bank-Muamalat-AR2020

P. 180

178 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

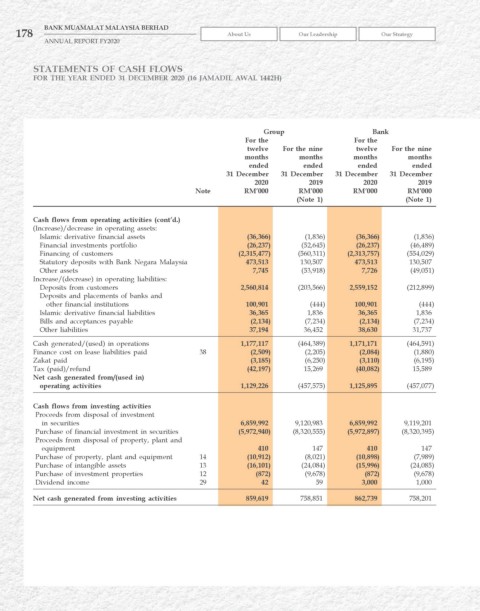

StatementS of caSh flowS

for the year ended 31 december 2020 (16 Jamadil awal 1442h)

Group Bank

For the For the

twelve For the nine twelve For the nine

months months months months

ended ended ended ended

31 December 31 December 31 December 31 December

2020 2019 2020 2019

Note rM’000 rM’000 rM’000 rM’000

(Note 1) (Note 1)

Cash flows from operating activities (cont’d.)

(Increase)/decrease in operating assets:

Islamic derivative financial assets (36,366) (1,836) (36,366) (1,836)

Financial investments portfolio (26,237) (52,645) (26,237) (46,489)

Financing of customers (2,315,477) (560,311) (2,313,757) (554,029)

Statutory deposits with Bank Negara Malaysia 473,513 130,507 473,513 130,507

Other assets 7,745 (53,918) 7,726 (49,051)

Increase/(decrease) in operating liabilities:

Deposits from customers 2,560,814 (203,566) 2,559,152 (212,899)

Deposits and placements of banks and

other financial institutions 100,901 (444) 100,901 (444)

Islamic derivative financial liabilities 36,365 1,836 36,365 1,836

Bills and acceptances payable (2,134) (7,234) (2,134) (7,234)

Other liabilities 37,194 36,452 38,630 31,737

Cash generated/(used) in operations 1,177,117 (464,389) 1,171,171 (464,591)

Finance cost on lease liabilities paid 38 (2,509) (2,205) (2,084) (1,880)

Zakat paid (3,185) (6,250) (3,110) (6,195)

Tax (paid)/refund (42,197) 15,269 (40,082) 15,589

Net cash generated from/(used in)

operating activities 1,129,226 (457,575) 1,125,895 (457,077)

Cash flows from investing activities

Proceeds from disposal of investment

in securities 6,859,992 9,120,983 6,859,992 9,119,201

Purchase of financial investment in securities (5,972,940) (8,320,555) (5,972,897) (8,320,395)

Proceeds from disposal of property, plant and

equipment 410 147 410 147

Purchase of property, plant and equipment 14 (10,912) (8,021) (10,898) (7,989)

Purchase of intangible assets 13 (16,101) (24,084) (15,996) (24,085)

Purchase of investment properties 12 (872) (9,678) (872) (9,678)

Dividend income 29 42 59 3,000 1,000

Net cash generated from investing activities 859,619 758,851 862,739 758,201