Page 179 - Bank-Muamalat-AR2020

P. 179

177

Our Performance Sustainability Statement Governance Our Numbers Other Information

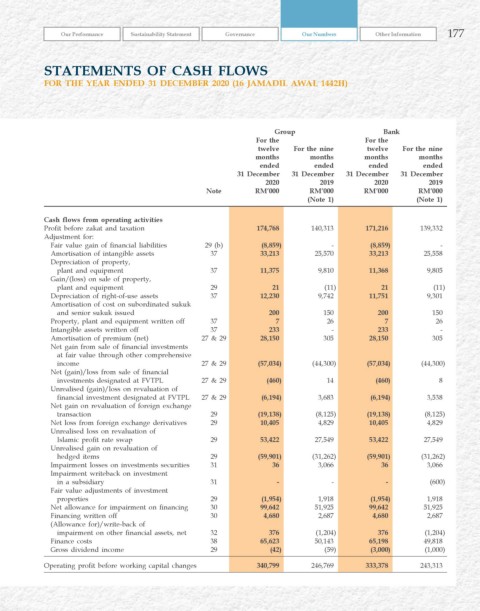

StatementS of caSh flowS

for the year ended 31 december 2020 (16 Jamadil awal 1442h)

Group Bank

For the For the

twelve For the nine twelve For the nine

months months months months

ended ended ended ended

31 December 31 December 31 December 31 December

2020 2019 2020 2019

Note rM’000 rM’000 rM’000 rM’000

(Note 1) (Note 1)

Cash flows from operating activities

Profit before zakat and taxation 174,768 140,313 171,216 139,332

Adjustment for:

Fair value gain of financial liabilities 29 (b) (8,859) - (8,859) -

Amortisation of intangible assets 37 33,213 25,570 33,213 25,558

Depreciation of property,

plant and equipment 37 11,375 9,810 11,368 9,805

Gain/(loss) on sale of property,

plant and equipment 29 21 (11) 21 (11)

Depreciation of right-of-use assets 37 12,230 9,742 11,751 9,301

Amortisation of cost on subordinated sukuk

and senior sukuk issued 200 150 200 150

Property, plant and equipment written off 37 7 26 7 26

Intangible assets written off 37 233 - 233 -

Amortisation of premium (net) 27 & 29 28,150 305 28,150 305

Net gain from sale of financial investments

at fair value through other comprehensive

income 27 & 29 (57,034) (44,300) (57,034) (44,300)

Net (gain)/loss from sale of financial

investments designated at FVTPL 27 & 29 (460) 14 (460) 8

Unrealised (gain)/loss on revaluation of

financial investment designated at FVTPL 27 & 29 (6,194) 3,683 (6,194) 3,538

Net gain on revaluation of foreign exchange

transaction 29 (19,138) (8,125) (19,138) (8,125)

Net loss from foreign exchange derivatives 29 10,405 4,829 10,405 4,829

Unrealised loss on revaluation of

Islamic profit rate swap 29 53,422 27,549 53,422 27,549

Unrealised gain on revaluation of

hedged items 29 (59,901) (31,262) (59,901) (31,262)

Impairment losses on investments securities 31 36 3,066 36 3,066

Impairment writeback on investment

in a subsidiary 31 - - - (600)

Fair value adjustments of investment

properties 29 (1,954) 1,918 (1,954) 1,918

Net allowance for impairment on financing 30 99,642 51,925 99,642 51,925

Financing written off 30 4,680 2,687 4,680 2,687

(Allowance for)/write-back of

impairment on other financial assets, net 32 376 (1,204) 376 (1,204)

Finance costs 38 65,623 50,143 65,198 49,818

Gross dividend income 29 (42) (59) (3,000) (1,000)

Operating profit before working capital changes 340,799 246,769 333,378 243,313