Page 182 - Bank-Muamalat-AR2020

P. 182

180 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

StatementS of caSh flowS

for the year ended 31 december 2020 (16 Jamadil awal 1442h)

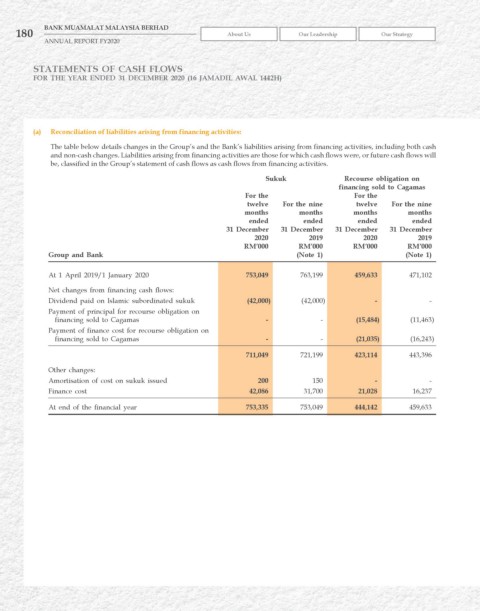

(a) reconciliation of liabilities arising from financing activities:

The table below details changes in the Group’s and the Bank’s liabilities arising from financing activities, including both cash

and non-cash changes. Liabilities arising from financing activities are those for which cash flows were, or future cash flows will

be, classified in the Group’s statement of cash flows as cash flows from financing activities.

Sukuk recourse obligation on

financing sold to Cagamas

For the For the

twelve For the nine twelve For the nine

months months months months

ended ended ended ended

31 December 31 December 31 December 31 December

2020 2019 2020 2019

rM’000 rM’000 rM’000 rM’000

Group and Bank (Note 1) (Note 1)

At 1 April 2019/1 January 2020 753,049 763,199 459,633 471,102

Net changes from financing cash flows:

Dividend paid on Islamic subordinated sukuk (42,000) (42,000) - -

Payment of principal for recourse obligation on

financing sold to Cagamas - - (15,484) (11,463)

Payment of finance cost for recourse obligation on

financing sold to Cagamas - - (21,035) (16,243)

711,049 721,199 423,114 443,396

Other changes:

Amortisation of cost on sukuk issued 200 150 - -

Finance cost 42,086 31,700 21,028 16,237

At end of the financial year 753,335 753,049 444,142 459,633