Page 162 - Bank-Muamalat-AR2020

P. 162

160 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

DIRECTORS’ REPORT

PrOSPECTS (CONT’D.)

Against this backdrop, the Bank will re-prioritise its business strategies to move forward. In line with the ongoing implementation

1

of RISE24 , i.e. the Bank’s 5-Year Strategic Business Plan, the Bank will continue to uphold its asset quality, build buffers to defend

against higher delinquencies, kick start an intensive recovery plan, and strengthen liquidity and capital management. It will also

explore new growth areas and expand its distribution channels to remain competitive in the post pandemic landscape. The Bankwill

drive growth in high potential segments, innovate products to close the gaps in product offerings and leverage on technology to

manage process and service efficiency.

Recognising the emerging risks associated with the current economic conditions, the Bank has taken the necessary steps to mitigate

and minimise these risks, in accordance with BNM’s guidelines. The Bank will continue to exercise effective Risk and Compliance

Management programmes for a more robust enforcement of regulatory requirements and in managing legal and reputational risks.

The Bank is also focusing on streamlining its business activities for continuous business resilience. Action plans are in place to

cushion the impact of any potential adverse effects on the Bank’s financial performance and balance sheet.

Moving forward, the Bank anticipates a better growth for the year, with overall asset expected to grow on the back of better prospects

in overall domestic economic expansion. The Bank also forecasts its gross financing to increase for FY2021 due to anticipated growth

in retail financing as the current low profit/interest rate environment, which is beneficial for retail consumers, is expected to remain

until year-end.

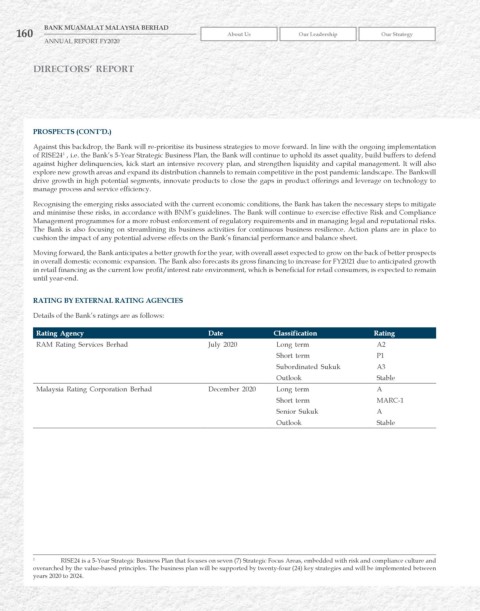

rATING By ExTErNAL rATING AGENCIES

Details of the Bank’s ratings are as follows:

rating Agency Date Classification rating

RAM Rating Services Berhad July 2020 Long term A2

Short term P1

Subordinated Sukuk A3

Outlook Stable

Malaysia Rating Corporation Berhad December 2020 Long term A

Short term MARC-1

Senior Sukuk A

Outlook Stable

1 RISE24 is a 5-Year Strategic Business Plan that focuses on seven (7) Strategic Focus Areas, embedded with risk and compliance culture and

overarched by the value-based principles. The business plan will be supported by twenty-four (24) key strategies and will be implemented between

years 2020 to 2024.