Page 15 - Bank-Muamalat-AR2020

P. 15

13

Our Performance Sustainability Statement Our Governance Our Numbers Other Information

CONNECTED

PARTIES

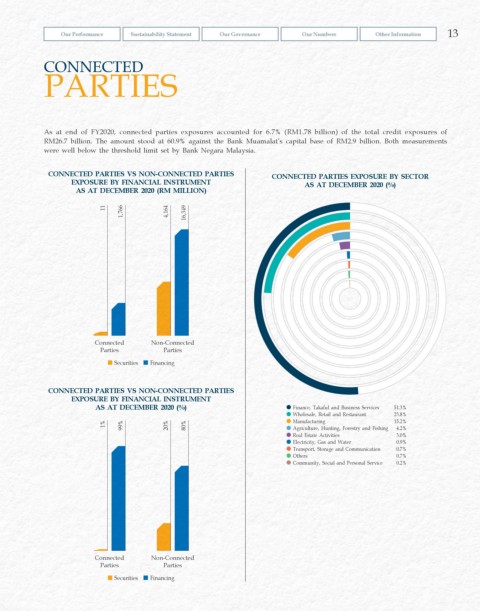

As at end of FY2020, connected parties exposures accounted for 6.7% (RM1.78 billion) of the total credit exposures of

RM26.7 billion. The amount stood at 60.9% against the Bank Muamalat’s capital base of RM2.9 billion. Both measurements

were well below the threshold limit set by Bank Negara Malaysia.

CONNECTED PARTIES VS NON-CONNECTED PARTIES CONNECTED PARTIES EXPOSURE BY SECTOR

EXPOSURE BY FINANCIAL INSTRUMENT AS AT DECEMBER 2020 (%)

AS AT DECEMBER 2020 (RM MILLION)

11

1,766 4,164 16,349

Connected Non-Connected

Parties Parties

Securities Financing

CONNECTED PARTIES VS NON-CONNECTED PARTIES

EXPOSURE BY FINANCIAL INSTRUMENT

AS AT DECEMBER 2020 (%) Finance, Takaful and Business Services 51.3%

Wholesale, Retail and Restaurant 23.8%

1% 99% 20% 80% Manufacturing 15.2%

Agriculture, Hunting, Forestry and Fishing

4.2%

Real Estate Activities 3.0%

Electricity, Gas and Water 0.9%

Transport, Storage and Communication 0.7%

Others 0.7%

Community, Social and Personal Service 0.2%

Connected Non-Connected

Parties Parties

Securities Financing