Page 324 - Bank-Muamalat_Annual-Report-2023

P. 324

BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2023 (18 JAMADIL AKHIR 1445H)

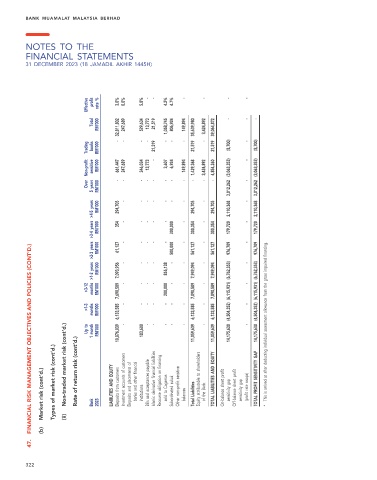

Effective profit rate % 3.0% 0.0% 5.8% - - 4.2% 4.7% - - - -

- - -

Total RM’000 32,811,802 247,689 529,634 13,773 21,519 1,058,745 806,924 149,894 35,639,980 3,424,892 39,064,872

Trading books RM’000 - - - - 21,519 - - - 21,519 - 21,519 (8,700) - (8,700)

Over Non-profit sensitive 5 years RM’000 RM’000 661,447 - 247,689 - 346,034 - 13,773 - - - 3,607 - 6,924 - 149,894 - 1,429,368 - 3,424,892 - 4,854,260 - 3,012,262 (3,063,353) - - 3,012,262 (3,063,353)

months >1-2 years >2-3 years >3-4 years >4-5 years RM’000 61,127 500,000 561,127 561,127 976,709 976,709

RM’000 294,705 - - - - - - - 294,705 - 294,705 2,110,368 - 2,110,368

RM’000 354 - - - - - 300,000 - 300,354 - 300,354 179,720 - 179,720

- - - - - - - -

FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

RM’000 7,093,956 - - - - 855,138 - - 7,949,094 - 7,949,094 -

>3-12 RM’000 7,690,589 - - - - 200,000 - - 7,890,589 - 7,890,589 -

>1-3 Up to months 1 month RM’000 RM’000 6,133,585 10,876,039 - - - 183,600 - - - - - - - - - - 6,133,585 11,059,639 - - 6,133,585 11,059,639 14,175,630 (4,504,352) (6,115,931) (6,762,353) - - 14,175,630 (4,504,352) (6,115,931) (6,762,353) This is arrived at after deducting individual assessment allowance from the gross impaired financing.

Market risk (cont’d.) Types of market risk (cont’d.) Non-traded market risk (cont’d.) Rate of return risk (cont’d.) Bank 2023 LIABILITIES AND EQUITY Deposits from customers Investment accounts of customers Deposits and placements of banks and other financial institutions Bills and acceptances payable Islamic derivative financial liabilities Recourse obligation on financing sold to Cagamas Subordinated sukuk Other non-profit sensitive bala

(b) (ii)

47.

322